Students can Download 1st PUC Accountancy Model Question Paper 4 with Answers, Karnataka 1st PUC Accountancy Model Questions with Answers helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka 1st PUC Accountancy Model Question Paper 4 with Answers

Time: 3.15 minutes

Max. Marks: 100

SECTION – A

I. Answer any eight questions. Each question carries one mark. (8 × 1 = 8)

Question 1.

Accounting begins with the identification of transactions and ends with the preparation of Statements.

Answer:

Financial

Question 2.

A concept that a business enterprise will not be sold or liquidated in the near future is known as:

(a) Going Concern.

(b) Economic Entity.

(c) Monetary Unit.

(d) None of the above.

Answer:

(a) Going Concern.

Question 3.

The process of recording transactions in Journal is called

Answer:

Journalising.

Question 4.

Ledger records transactions in

(a) Chronological order.

(b) Analytical order.

(c)Both a and b above.

(d)None of the above.

Answer:

(a) Chronological order.

![]()

Question 5.

Trial Balance is a Statement. (State True or False)

Answer:

True

Question 6.

A bill is drawn a 1/04/2017 for 3 months. Find out the date of Maturity.

Answer:

The maturity date of Bill is 4-6-2017.

Question 7.

How do you treat interest on capital while preparing Profit and loss account?

Answer:

How do you treat interest on capital is debited to profit and loss account

Question 8.

Why the Statement of Affairs is prepared?

Answer:

To find out capital i.e. both opening as well a/c losing capital.

![]()

Question 9.

Expand AIS.

Answer:

Accounting information system.

Question 10.

Give an example for Accounting Software.

Answer:

Tally, ERP.

SECTION – B

II. Answer any five questions. Each question carries two marks. (5 × 2= 10)

Question 11.

Define Accounting.

Answer:

“The art of recording classifying and summarising in a significant manner and in terms of money transactions event which are, in part atleast, of a financial character and interpreting the results there of “American certificed public accountants”.

Question 12.

What is Double Entry System?

Answer:

The system of making two sides in the books of each contracting party for recording a transactions completely called double entry system.

Question 13.

State the Rules of Debit and Credit of Assets Account.

Answer:

Debit what comes in credit what goes out.

![]()

Question 14.

Why the Bank Reconciliation Statement is prepared?

Answer:

To reconcile, two Balance i.e., Balance as per cash book, Balance as per pass book.

Question 15.

Purchase of Machinery for 25,000 has been entered in the Purchases Book. Give the Rectifying Entry.

Answer:

Machinery a/c Dr 25000

To purchase a/c 25000

(Being machinery purchased on credit wrongly entered in purchase book know rectified)

Question 16.

Name any two example of ‘Provision’.

Answer:

- Provision for depreciation

- Provision for taxation.

Question 17.

Give an example for Closing Entry.

Answer:

Trading a/c Dr XXX

To opening stock a/c XXX

(Being opening stock a/c closed by transferring to debit side of trading account)

![]()

Question 18.

What are the functional components of Computer System?

Answer:

- Input unit

- Untral processing unit

- Output unit

SECTION – C

III. Answer any four questions. Each question carries six marks. (4 × 6 = 24)

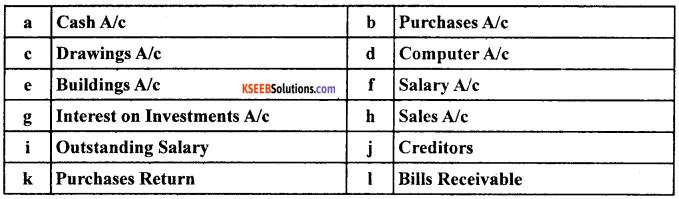

Question 19.

Classify the following Accounts into Assets, Liabilities, Capital, Revenue/Gains & Expenses/Losses:

Answer:

Cash a/c – Asset – Real A/c

Purchase a/c – Asset – Real A/c

Computer a/c – liability – personal a/c

Building a/c – Asset – Real a/c

Salary a/c – Expenses – Nominal A/c

Interestion investment a/c – Income – nominal a/c

Sales -a/c Assets – Real a/c

Liability-personal a/c

Liability- personal a/c

Asset-real A/c

Assets – personal a/c

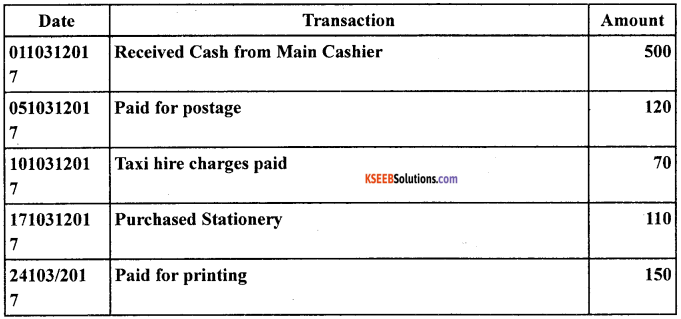

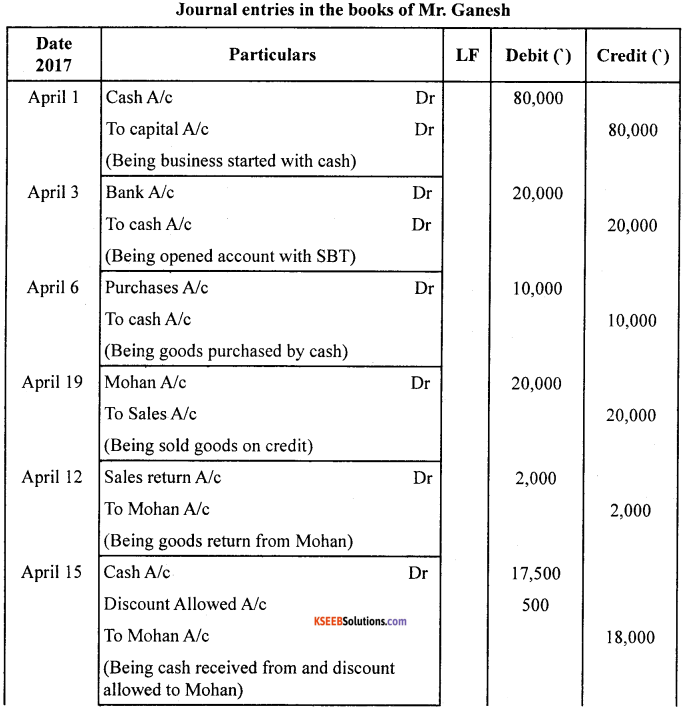

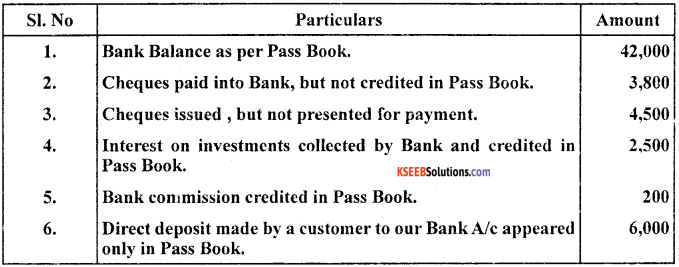

Question 20.

Enter the following transactions in an Analytical Petty Cash Book:

Answer:

![]()

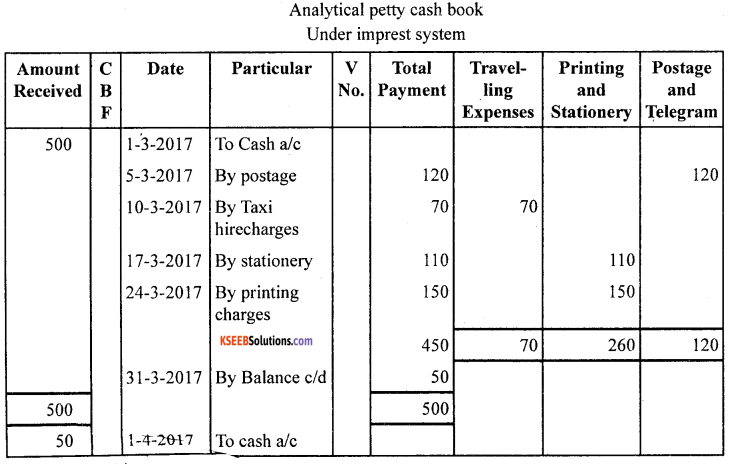

Question 21.

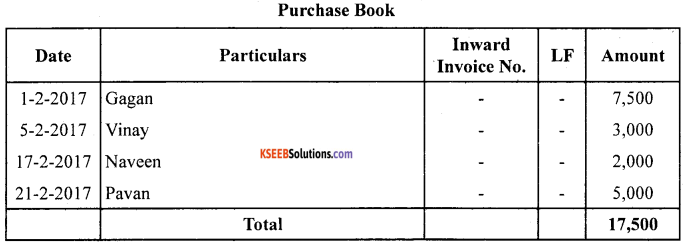

From the following transactions, prepare Purchases Book:

Answer:

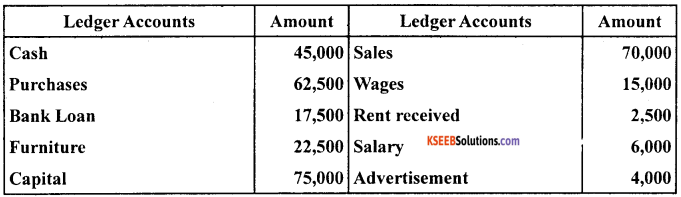

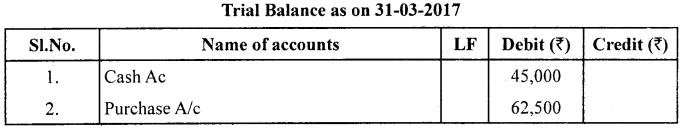

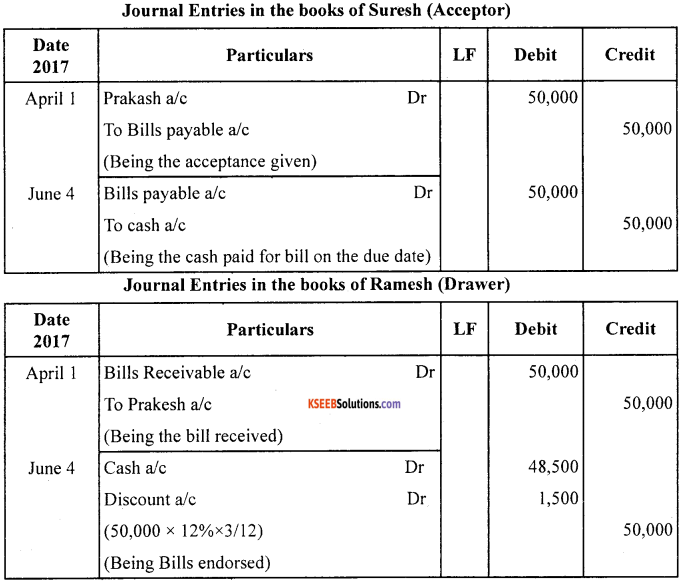

Question 22.

From the following ledger balances, prepare the Trial Balance as on 31/03/2017:

Answer:

Question 23.

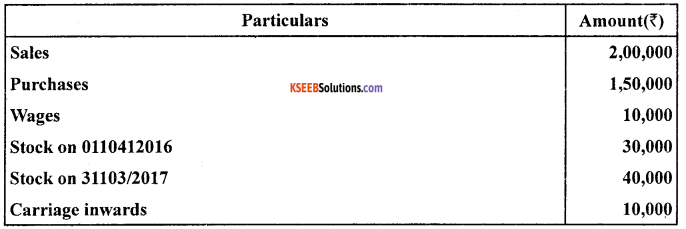

Compute cost of goods sold for the year 2017:

Answer:

Calculation of cost of goods sold for the year 2017:

Cost of goods sold = opening stock + Purchased + Direct expenses – closing stock

= 30,000 + 1,50,000 + (10,000 + 10,000) – 40,000

= 30,000 + 1,50,000 + 20,000 – 40,000

= 2,00,000 – 40,000

Cost of goods sold = ₹ 1,60,000

Note: Direct expenses includes both wages as well as carriage inwards.

![]()

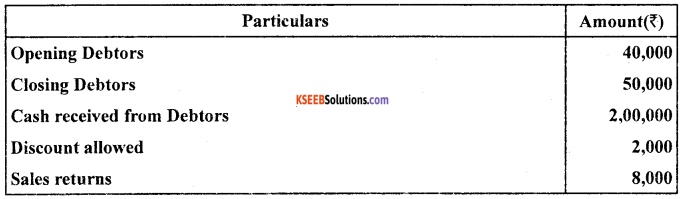

Question 24.

Find out the Credit Sales by preparing Total Debtors A/c:

Answer:

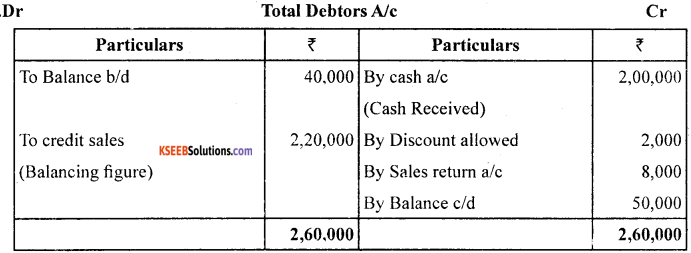

Question 25.

Distinguish between Manual Accounting System and Computerised Accounting System.

Answer:

SECTION – D

IV. Answer any four questions. Each question carries twelve marks. (4 × 12 = 48)

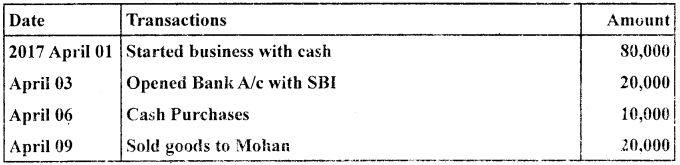

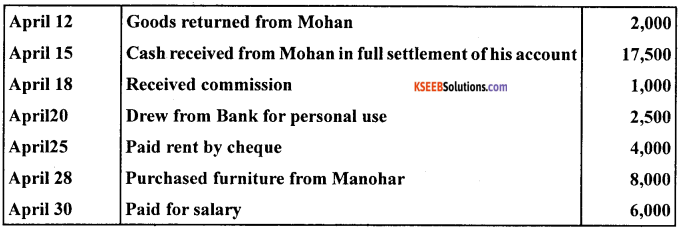

Question 26.

Journalise the following transactions in the books of Shri Ganesh:

Answer:

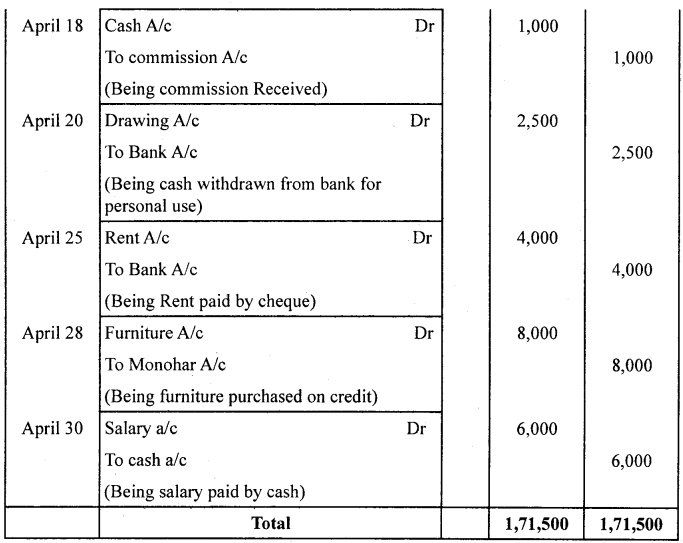

Question 27.

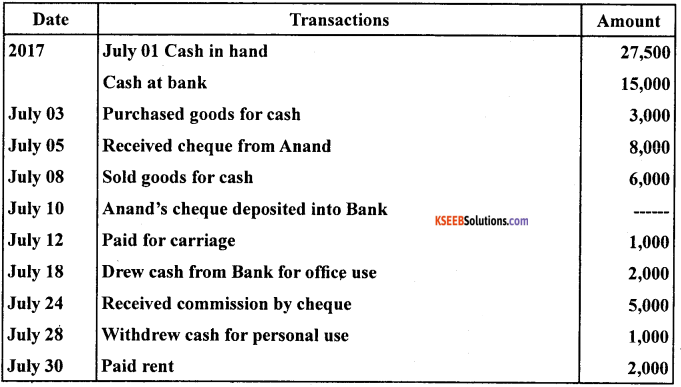

From the following transactions, prepare Double Column Cash Book.

Answer:

![]()

Question 28.

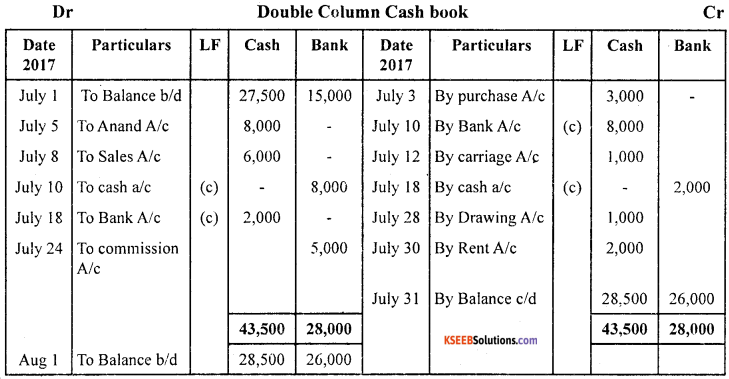

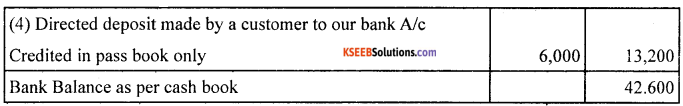

From the following information, prepare Bank Reconciliation

Statement:

Answer:

Question 29

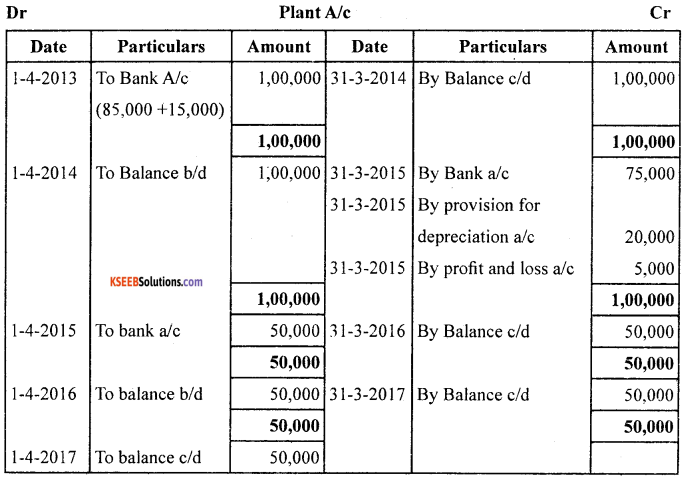

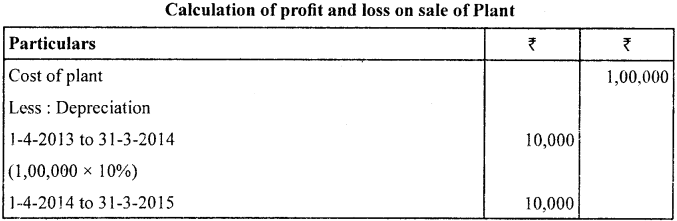

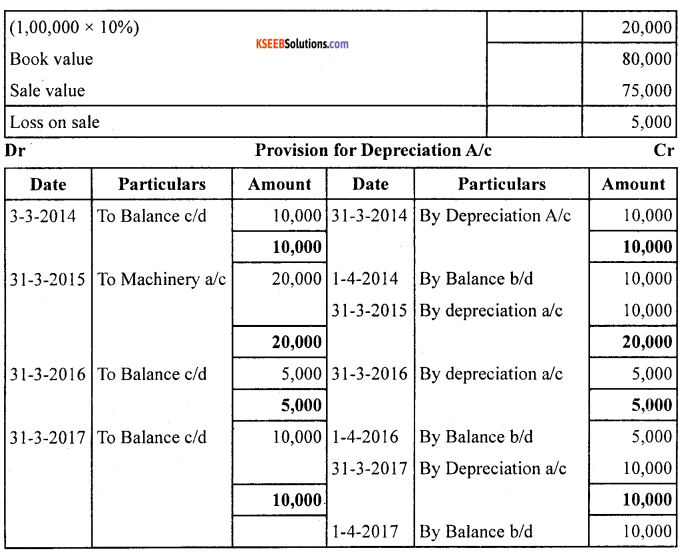

On 01/04/2013, Santosh Company Ltd. purchased a Plant costing ₹ 85,000 and spent ₹ 15,000 for its erection. On 31/03/2015, the Plant was sold ₹ 75,000. On 01/04/2015, a new Plant was purchased for ₹ 50,000. The firm charges depreciation @ 10% PA under Straight Line Method. Accounts are closed on 31st March every year.

Prepare 1. Plant A/c and

2. Provision for Depreciation Ale for the first 4 years.

Answer:

Question 30.

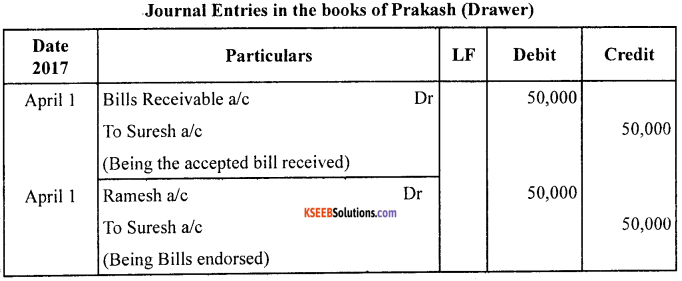

On 01/04/2017, Prakash drew a Bill on Suresh for ₹ 50,000 payable after 3 months. Suresh accepted the Bill and returned it to Prakash. On the same date, Prakash endorsed the Bill to Ramesh: on the above date, the Bill is discounted by Ramesh @12% pa. On the due date the Bill is honoured.

Pass the Journal Entries in the books of Prakash, Suresh, and Ramesh.

Answer:

Note: No Journal entry in the books of endorser (Prakash) when the bill is honoured at the date of maturity.

![]()

Question 31.

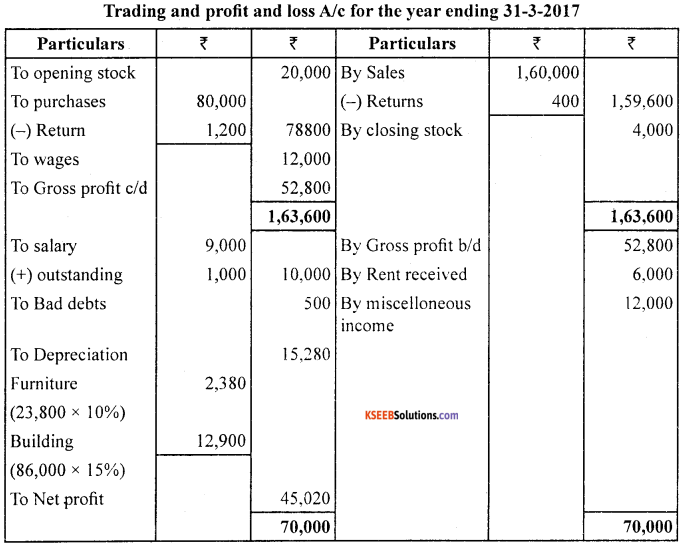

From the following ledger balances and adjustments, prepare Trading Ale, Profit and Loss A/c and Balance Sheet.

Adjustments:

- Closing Stock was valued at ₹4,000.

- Depreciate furniture by 10% pa. and building by 15% pa.

- Bad Debts written off ₹500.

- Salary Outstanding ₹1,000

Answer:

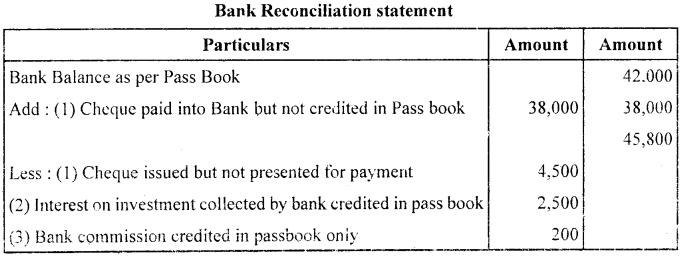

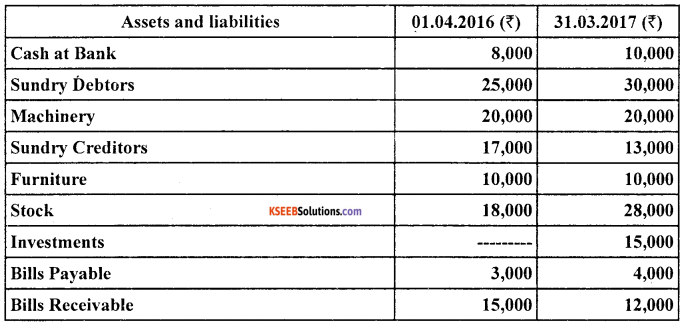

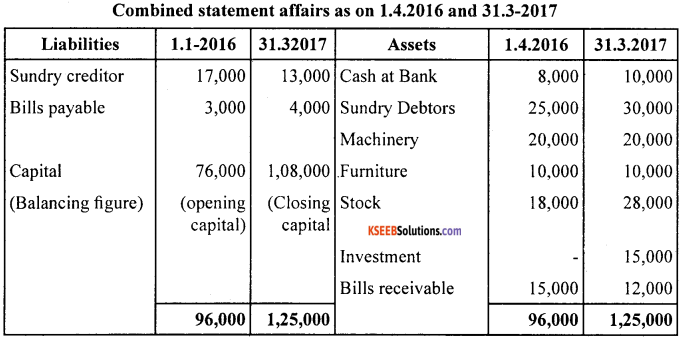

Question 32.

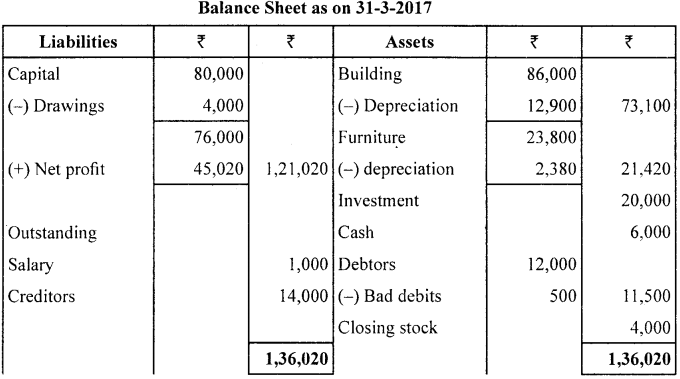

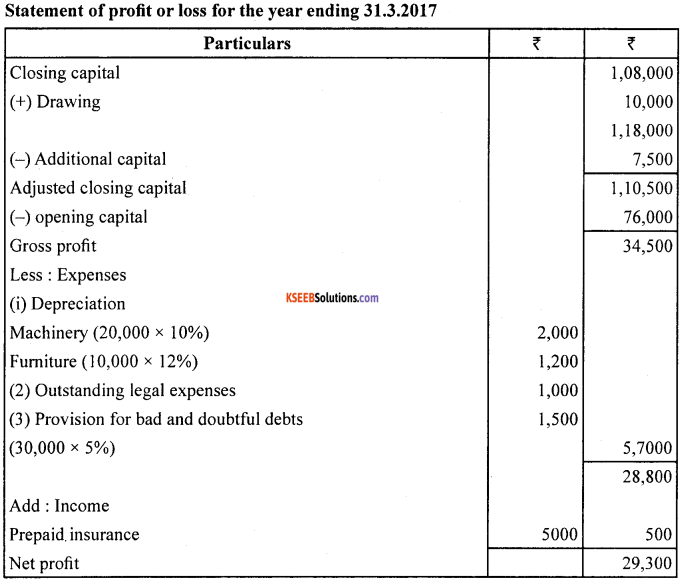

Anand keeps his books under Single Entry System: From the following information, prepare Statement of Profit and loss and Revised Statement of Affairs as on 31/03/2017.

![]()

During the year, Anand withdrew ₹10,000 for his personal use and introduced a further capital of ₹7,500.

Adjustments:

- Depreciate Machinery by 10% pa & Furniture by 12% pa.

- Provide for Bad and Doubtful Debts @5% on Sundry Debtors

- Prepaid Insurance ₹500.

- Legal Expenses due but not paid ₹1,000.

Answer:

SECTION – E

(Practical Oriented Questions)

V. Answer any two questions. Each question carries five marks. (2 × 5 = 10)

Question 33.

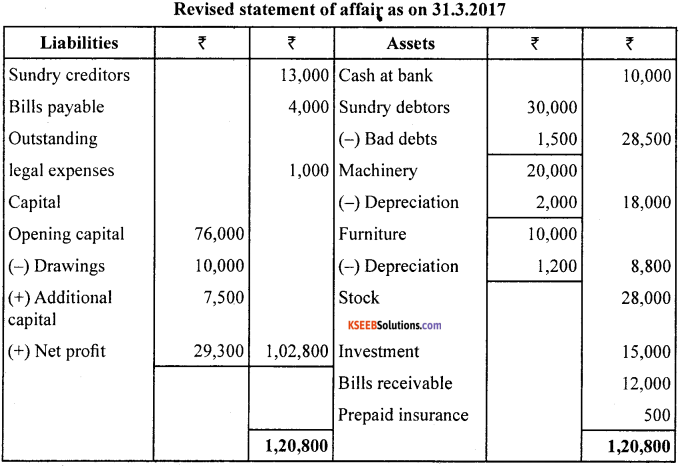

Write the Accounting Equation for each item and find the missing figure:

Answer:

a. Assets = Liabilities + Capital

1,00,000 = 60,000 + Capital

Capital = 100000 – 60000

Capital = ₹ 40,000

Formula to find out capital:

Capital = Assets – liabilities

b. Formula to find out liability

Assets – Capital = Liability

90,000 – 45,000 = 45,000

Liability = ₹ 45,000

c. Formula to find out assets

Assets = Liabilities + capital

= 24,000 + 56,000

Assets = ₹80,000

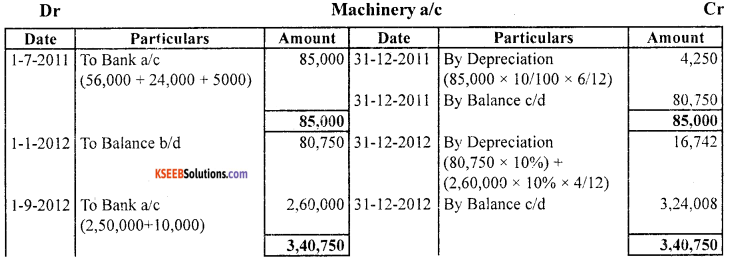

Question 34.

Prepare Machinery Ale for two years with imaginary figures under. Written Down Value Method.

Answer:

![]()

Question 35.

Write the accounting equations and find out the missing figures

Answer:

a. Assets – Liabilities = Capital

₹ 50,000 – ₹ 30,000 = ₹ 20,000

b. Asset = liabilities + Capital

₹ 45000 = ₹ 25,000 + ₹ 20,000

c. Liabilities = Assets – Capital

₹ 24,000 = ₹ 40,000 – ₹ 16,000