You can Download Chapter 7 Depreciation, Provisions and Reserves Questions and Answers, Notes, 1st PUC Accountancy Question Bank with Answers Karnataka State Board Solutions help you to revise complete Syllabus and score more marks in your examinations.

Karnataka 1st PUC Accountancy Question Bank Chapter 7 Depreciation, Provisions and Reserves

1st PUC Depreciation, Provisions and Reserves Two Marks Questions and Answers

Question 1.

State any two features of Depreciation.

Answer:

- It is simple and easy to calculate.

- It can reduce the book value of the asset to zero.

Question 2.

State any two causes of depreciation.

Answer:

- Wear and tear and

- Passage of time.

Question 3.

State any two reasons for charging depreciation.

Answer:

- To show correct profit/loss position.

- To show the asset at the correct market value.

Question 4.

Mention any two factors affecting the amount of annual depreciation.

Answer:

- Cost of the asset and

- Scrap value

![]()

Question 5.

State the two methods of depreciation.

Answer:

- Straight line method

- Diminishing value method

Question 6.

What is the straight line method of depreciation?

Answer:

Under this method, a fixed percentage of the original cost is written off every year, as annual depreciation.

Question 7.

What is the written down value method of depreciation?

Answer:

Under this method, depreciation at fixed percentage is calculated on the reduced balance of the asset brought forward from the previous year.

Question 8.

State any two differences between straight line method and diminishing balance method.

Answer:

| Points of difference | Straight line method | WDV method |

| 1. Calculation of depreciation. | Depreciation is calculated on the original cost of the asset. | Depreciation is calculated on the written down value of the asset. |

| 2. Calculation of rate of depreciation. | It is easy to calculate the rate of depreciation. | It is very difficult to calculate the rate of depreciation. |

Question 9.

What is annuity method?

Answer:

Under this method, not only the reduced cost of the asset is charged as depreciation, but also the interest it would have carried in case the cost of the asset is invested outside. The depreciation will be as per annuity table.

Question 10.

Give the meaning of depreciation fund method.

Answer:

Under this system, the amount written off as depreciation should be kept aside and invested in readily saleable securities. When the life of the asset expires, the securities are sold and a new asset is purchased with the help of sale proceeds.

![]()

Question 11.

What do you mean by insurance policy method?

Answer:

Under this method, an insurance policy is taken for the required sum for replacing the asset to be written off.

Question 12.

What is revaluation method?

Answer:

Under this method, the market value of the asset is ascertained at the end of each year. Any difference between the book value and market value is the depreciation.

Question 13.

What is Provision?

Answer:

Provision is a charge against profit to meet certain known liabilities or contingencies.

Question 14.

What is Reserve?

Answer:

Reserve is an appropriation of profit retained to meet unknown liabilities or contingencies.

Question 15.

State any two types of reserves.

Answer:

- Capital reserve and

- Revenue reserve.

Question 16.

State any two types of revenue reserves.

Answer:

- General reserves

- Specific reserves

Question 17.

What is Capital reserve?

Answer:

Capital reserve is created out of Capital profits which is used for writing off capital losses or issue of bonus shares.

Question 18.

What is Revenue reserve?

Answer:

Revenue reserve is created out of the revenue profits which arise out of the normal operating activities of the business.

Question 19.

What is General reserve?

Answer:

When the purpose for which a reserve is created is not specified, it is called a General reserve.

Question 20.

What is Specific reserve?

Answer:

Specific reserve is the reserve which is created for some specific purpose and can be utilised only for that purpose.

Question 21.

Give two examples for Capital reserve.

Answer:

- Profit on sale of fixed assets and

- Premium on issue of shares or debentures.

Question 22.

Give two examples for Revenue reserve.

Answer:

- General reserve and

- Investment fluctuation reserve.

Question 23.

State any two differences between provisions and reserves.

Answer:

| Provisions | Reserves |

| 1. It is a charge against profit. | 1.It is an appropriation of profits |

| 2. It is created even if there is loss. | 2. It is created only if there is profit. |

Question 24.

What is Depreciation?

Answer:

Decrease in the value of fixed assets due to their regular use or expiry of time is termed as depreciation.

![]()

1st PUC Depreciation, Provisions and Reserves Additional Questions And Answers

Question 1.

State briefly the need for providing depreciation.

Answer:

The needs for providing depreciation are given below:

a. To ascertain true net profit or net loss

b. To show true and fair view of financial statements

c. For ascertaining the accurate cost of production

d. Distribution of dividend out of profit

e. To provide funds for replacement of assets

f. Consideration of tax (Any two)

Question 2.

Explain basic factors affecting the amount of depreciation.

Answer:

a. Total cost of asset: The total cost of an asset is taken into consideration for ascertaining the amount of depreciation. The expenses incurred in acquiring, installing and constructing asset and bringing the asset to its usable condition are included in the total cost of asset.

b. Estimated useful life – Every asset has its useful life other than its physical life (in terms of number of years, units, etc.), used by a business. The useful life of an asset is considered to estimate the effective life of a fixed asset.

c. Estimated scrap value – It is estimated as the net realizable value or sale value of an asset at the end of its effective life. It is deducted from the total cost of an asset.

Question 3.

Distinguish between straight line method and written down value method of calculating depreciation.

Answer:

| Straight line Method | Written down value method |

| The basis of charge is the original cost of acquisition of the asset. | The basis of charging depreciation is net book value (i.e., original cost less depreciation till date) of the asset |

| A fixed amount is charged every year during the life time of an asset. | The charge of depreciation declines every year with respect to the book. |

| Straight line method is not recognized by income Tax Act. | Written down value method is recognized by the income Tax Act. |

Question 4.

In case of a long term asset, repair and maintenance expenses are expected to rise later years than in earlier year. Which method is suitable for charging depreciation if the management does not want to increase burden on profits and loss account on account of depreciation and repair.

Answer:

If the management does not want to expert undue burden on the profits due to high depreciation and repair costs in the latter years of the assets, then ‘written down method’ should be a preferred method to provide depreciation. This is because the cost of depreciation reduces; whereas, repair and maintenance expenses increase in the latter years. However, on ‘ the whole, it does not expert increasing burden on profits.

Question 5.

What are the effects of depreciation on profit and loss account and balance sheet?

The effects of depreciation on Profit and Loss Account are given below.

Answer:

a. Depreciation increases the debit side of profit and loss account and hence reduces net profit.

b. Depreciation increases the total expenses, leading to an excess of debit over credit balance.

The effects of depreciation on Balance Sheet are given below.

a. It reduces the original cost or book value of the concerned asset.

b. It reduces the overall balance of asset’s column in the balance sheet.

![]()

Question 6.

Distinguish between provision and reserve.

Answer:

| Basis of Difference | Provision | Reserve |

| 1. Meaning | It is created to meet the known liability. | It is created to meet unknown liability. |

| 2. Nature | Provision is charged against profit. | Reserve is appropriation of the profit. |

| 3. Purpose | It is created for a specific liability. | It is created for strengthening the financial position. |

| 4. Mode of creation | It is created by debiting the profit and loss account. | It is created by debiting the profit and loss appropriation account. |

| 5. Use of payment of dividend | It cannot be used for payment of dividends. | It can be used for payment of dividends. |

| 6. Creation | Creation of provision is compulsory. It is created even if there is no profit. | Creation of reserve depends on the discretion of the management. It is created only when there is profit. |

Question 7.

Give four examples for provision and reserves.

Answer:

Four examples of provision are:

a. Provision for bad and doubtful debts

b. Provision for discount on debtors

c. Provision for depreciation

d. Provision for taxiation

Examples of reserve are:

a. General reserve

b. Capital resserve

c. Dividend equalization reserve

d. Debenture redemption reserve

Question 8.

Distinguish between revenue reserve and capital reserve.

Answer:

| Basis of difference | Revenue Reserve | Capital Reserve |

| 1. Source of creation | It is created out of revenue profits which arise out of normal operating activities of the business and are otherwise available for dividend distribution. | It is created primarily out of capital profit and not available for dividend distribution. But revenue profits may also be used for this purpose. |

| 2. Purpose | It is created to strengthen the financial position to meet unforeseen contingencies for some specific purposes. | It is created for compliance of legal requirements or accounting practices. |

| 3. Usage | A specific revenue reserve can be utilized only for the earmarked purpose while a general reserve can be utilized for any purpose including distribution of dividend. | It can be utilized for specific purposes as provided in the law in force e.g. to write off capital losses or issue of bonus shares. |

Question 9.

Give four examples each of revenue reserve and capital reserves.

Answer:

Four examples of revenue reserve are given below:

- Genera Reserve

- Retained Earnings

- Dividend Equalization Reserve

- Debenture redemption Reserve

Four examples of capital reserve are given below

- Issues of shares at premium

- Profit or issue of shares

- Sale of fixed assets

- Profit on redemption of debentures.

![]()

Question 10.

Distinguish between genereal reserve and specific reserve

Answer:

| General Reserve | Specific Reserve |

| 1. There is no specific purpose for creating this reserve | 1. Specific reserve is the reserve created for some specific purpose |

| 2. It is also termed as free reserve because the management can freely utilize it for any purpose. | 2. Specific reserve can be utilized only for that purpose it has been created. |

Question 11.

Explain the concept of secret reserve.

Answer:

Reserves that are created by overstating liabilities or understating assets are known as Reserves secrete reserves. They are not shown in the balance sheet. These reduce tax liabilities, as the liabilities are overstated. It is created by management to avoid competition by reducing profit. Creation of secrete reserve in not allowed by Companies Act, 1956 that requires full disclosure of all material facts and accounting policies while preparing final statements.

1st PUC Depreciation, Provisions and Reserves Essay Types/ Long Answers

Question 1.

Explain the concept of depreciation. What is the need for charging depreciation and what are the causes of depreciation?

Answer

Every business acquires fixed assets for its use in the business over a period of time. As the benefits of these assets can be availed over a long period of time (due to their regular use), there exists continuous wear and tear and consequently fall in their value. This fall in the value of fixed assets (due to regular use or expiry of time) is termed as depreciation. A machinery that costs Rs 1,00,000 and its useful life of 10 years, its depreciation will be calculated as:

a. To ascertain true net profit or net loss: Correct profit or loss can be ascertained when all the expenses and losses incurred for earning revenues are charged to profit and loss account. Assets are used for earning revenues and its cost is charged in form of depreciation from profit and loss account.

b. To show true and fair view of financial statements: If depreciation is not charged, assets are shown at higher value than their actual value in the balance sheet; consequently, the balance sheet does not reflect true view of financial statements.

c. For ascertaining the accurate cost of production: Depreciation on plant and machinery and other assets, which are engaged in production, is included in the cost of production. If depreciations not included, cost of production in under estimated, which will lead to low sale price and thus lead to low profit.

d. Distribution of dividend out of profit: If depreciation is not charged, which leads to over estimating of profit &nd consequently more profit is distributed as dividend, out of capital instead of the profit. This leads to the flight of scarce capital out of the business.

e. To provide funds for replacement of assets: Unlike other expenses, depreciation is not a cash expense. So, the amount of depreciation charged will be retained in the business and will be used for replacement of fixed assets after its useful life.

f. Consideration of tax: If depreciation is charged, then profit and loss account will disclose less profit as to when the depreciation is not charged. This depicts reduced profit and thus the business will be liable for lesser tax amount.

The causes for depreciation:

a. Constant use: Due to constant use of the fixed assets there exists normal wear and tear that leads to fall in the value of fixed assets.

b. Expiry of time: With the passage of time, whether assets are used or not, its effective life decreases. The natural forces like rain, weather, etc. lead to deterioration of the fixed assets.

c. Obsolescence: Due to the fast technological innovations and inventions today’s assets may be out dated by tomorrow’s sophisticated assets. This leads to the obsolescence of fixed assets.

d. Expiry of legal rights: If an asset is acquired for a specific period of time, then, whether the asset is put to use or not, its value becomes zero at the end of its useful life.

e. Accident – An asset may lose its value and damage may happen to it due to mishaps such as a fire accidents, theft or a natural calamity. The loss due to accident is permanent in nature.

f. Permanent fall in value – Generally, we do not record fluctuations in the market price of the fixed assets in the books. However, if the fall in market price is permanent, it is accounted, which leads to a fall in the value of fixed assets in the books.

![]()

Question 2.

Discuss in detail the straight line method and written down value method of depreciation. Distinguish between the two and also give situations where they are useful. Straight line method.

Answer:

I. Advantages of Straight Line Method :

a. It is simple to calculate.

b. Asset can be completely written off, i.e., asset can be depreciated until the net scrap value is zero.

c. Same amount of depreciation is charged every year. Therefore, it helps in easy comparison of Profit and Loss Account for different years.

d. It is used for assets that have low repairs and maintenance expenses and are continuously used over a period of time.

Limitations of Straight Line Method :

a. Burden of depreciation is mere on profit and loss account in the later years, when repair and maintenance costs increase, as asset becomes older.

b. Value of asset becomes zero in the books even if asset is still in usable condition in business.

Uses of Straight Line Method :

- This method is useful where repairs and maintenance expenses on asset are low.

- It is also useful when an asset is continuously used from one year to another.

- It is useful when the value of assets, such as patent, copyright, goodwill, etc., becomes zero

II. Written Down value Method :

This method is applicable where depreciation is charged on the diminishing balance, i.e., book value of the asset. In this method, asset’s value goes on diminishing year after year and the amount of depreciation declines.

Advantages of Written Down value Method :

a. It is based on the logical assumption that asset is used more in the earlier years, so more cost is charged in form of depreciation.

b. It is suitable for the assets where repairs are more in the later years, as depreciation is lesser and on a whole the combined burden of depreciation and repairs experts equal pressure on the net profit over years.

c. This method is accepted by the income tax authorities.

d. As more depreciation is charged the earlier years, so the loss due to obsolescence of the asset is reduced.

Limitations of Written Down Value Method :

a. It is difficult to calculate and is a time consuming process.

b. The value of an asset cannot be zero, thus the asset cannot be completely written off,

c. There arises shortage of fuflds for replacement of new asset. This happens due to the fact that the amount of depreciation is retained and used in the business. Consequently, at the end of the useful life of an old asset, business finds it difficult to arrange funds for its replacement.

Uses of Written Down Value Method :

a. It is useful when assets have long life.

b. It is useful for those assets that require more repair and maintenance costs in the later years.

c. It provides easy calculation to provide depreciation of additional asset purchased during a year.

Question 3.

Difference between Straight Line Method and Written Down Value Method

Answer:

| S.No | Straight Line Method | Written Down Value Method |

| 1. | The basis of charge under straight line method is the original cost or cost of acquisition of the asset. | The basis of charging depreciation is net book value (i.e., original cost less depreciation till date) of the asset. |

| 2. | A fixed amount is charged every year during the life-time of an asset. | The charge of depreciation declines every year with respect to the book value of the asset because depreciation is charged on the book value and not on the original cost which is a reducing base. |

| 3. | Total charge against profit and loss account in respect of depreciation and repair expenses increases in later years under straight line method. | Depreciation charge declines in later years, therefore total of depreciation and repair charge remains similar or equal year after year. |

| 4. | Straight line method is not recognized by income Tax Act. | Written down value method is recognized by the income Tax Act. |

| 5. | Straight line method is suitable for assets in which repair charges are less the possibility of obsolescence is less and scrap value depends upon the time period involved. | Written down method is suitable for assets, which are affected by techonological changesand requires more repair expenses with passage of time |

Question 4.

What is Reserve? Explain different types.

Answer:

Reserves: Reserves are created for strengthening the financial positions and future growth. It’is created out of profit earned business.

1. Revenue Reserve: It is created out of revenue profit, i.e., revenue earned from normal activities of the business. It can be used for either general purpose or specific purpose.

It is of two types:

a. General Reserve: When the reserve is created without any specified purpose, then there serve is called general reserve. It is a free reserve and so can be used for any purpose. It can also be used for future growth and expansion. For example, reserve funds, retained earnings, contingencies reserves, etc.

b. Specific Reserve – When reserve is created for some specific purpose, then the reserve is called specific reserve. Example of specific reserve are given below.

Debenture Redemption Reserve, Investment Fluctuation Reserve.

Dividend Equalization Reserve, Workmen Compensation Fund.

c. Capital Reserve – It is created out of capital profit, i.e., gain from other than normal activities of business operations, such as sale of fixed asset, etc. it is created to meet the capital loss. It cannot be distributed as dividend.

The example of capital reserves are given below:

Premium on issue of Shares and debentures, Premium on issue of debentures.

Profit of redemption of debentures, Profit on sale of fixed assets.

Profit on reissue of forfeited shares Profit prior to incorporation.

d. Secrete Reserves: Reserves that are created by overstating liabilities or understating assets are known as secrete reserves. They are not shown in the Balance sheet. These reduce tax liabilities, as the liabilities are overstated. It is created by management to avoid competition by reducing profit.

Creation of secrete reserve is not allowed by Companies Act, 1956, which requires full disclosure of all materials facts and accounting policies, while preparing final statements.

![]()

Question 5.

What are provisions? How are they created? Give accounting treatment in case of provision for doubtful Debts.

Answer: Provisions are the amount that is created against profit to meet the known liability; however, the amount of liability is uncertain. It is created for specific liability. Creation of provision is compulsory even if, there is no profit. The underlying principle behind creation of provision is conservatism, viz., to prepare for future loss. The main rationale for making provisions is to provide cushion to the future business performance against the uncertain and unforeseen losses that may arise from the past transactions. A few examples of provisions are given below:

Provision for bad and doubtful debts

Provisions for depreciation

Provisions for taxation

Provisions for discount on debtors

Provisions are made by debiting the Profit and Loss Account on estimate basis. The provision are created on the basis of past experiences. Every year, a business may experience common losses, such as depreciation of fixed assets, taxation, etc., which are although known; however, their exact amount of future period is unknown. Thus, business creates provision of certain percentage every year, which is truly based on the intuitions and past experiences. These unascertained liabilities in form of provisions are kept aside, which help future business activities, undisturbed from the future losses.

Accounting treatment for provision for doubtful debts is:

Profit and Loss A/c Dr

To Provision for Doubtful Debts

(Provision for doubtful debt made)

1st PUC Depreciation, Provisions and Reserves Twelve Marks Questions and Answers

1st PUC Depreciation, Provisions and Reserves Numerical Problems

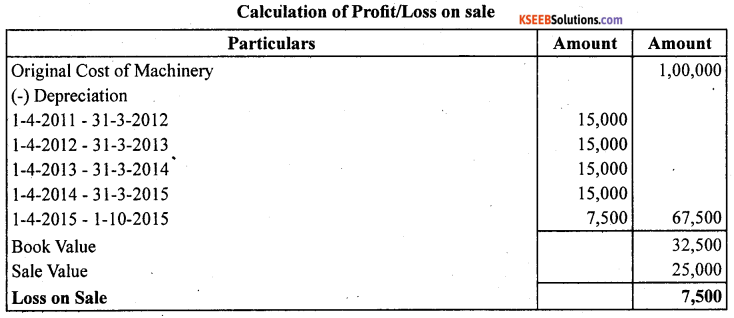

Question 1.

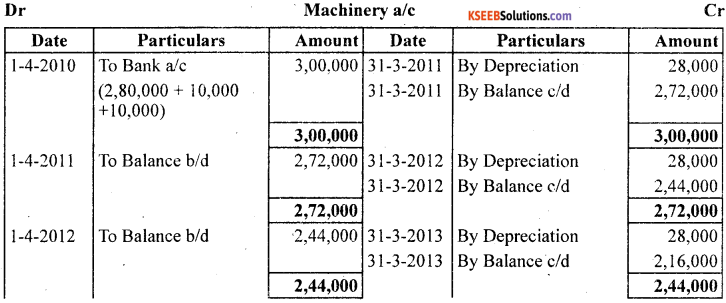

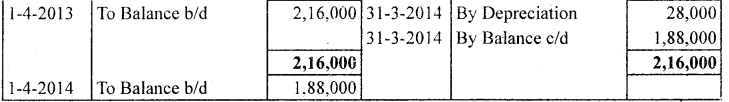

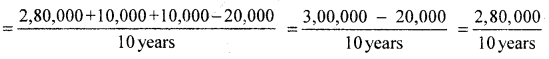

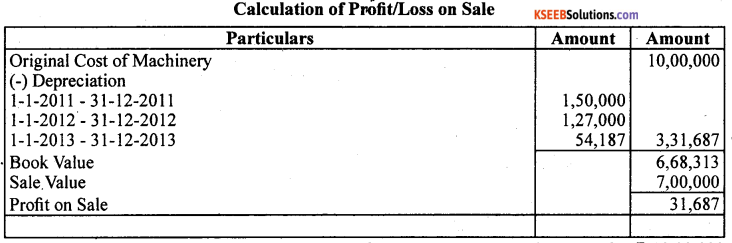

On April 01, 2000, Bajrang Marbles purchased a Machine for ₹ 2,80,000 and spent ₹ 10,000 on its carriage and ₹ 10,000 on its installation. It is estimated that its working life is 10 years its scrap value will be ₹ 20,000,

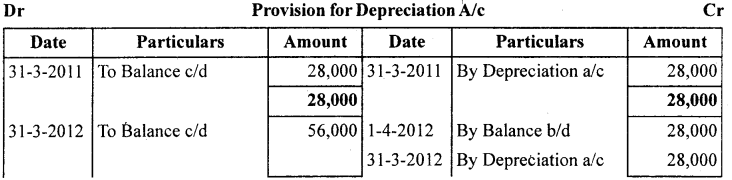

(a) Prepare Machine account and Depreciation account for the first four years by providing depreciation on straight line method. Accounts are closed on March 31st every year.

(b) Prepare Machinery account, Depreciation account and Provision for depreciation account (or accumulated depreciation account) for the first four years by providing depreciation on straight line method. Accounts are closed on March 31 st every year.

Answer:

(a)

(b)

Working Note 1:- Calculation of Depreciation.

Depreciation = 28,000 p.a.

![]()

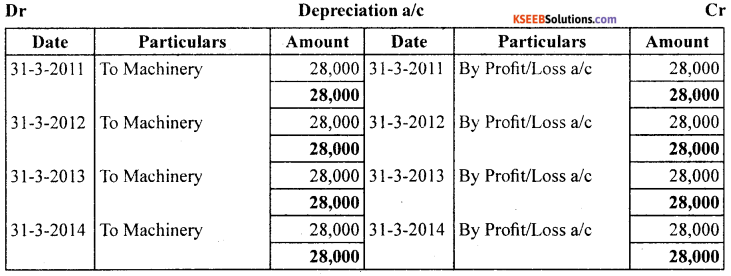

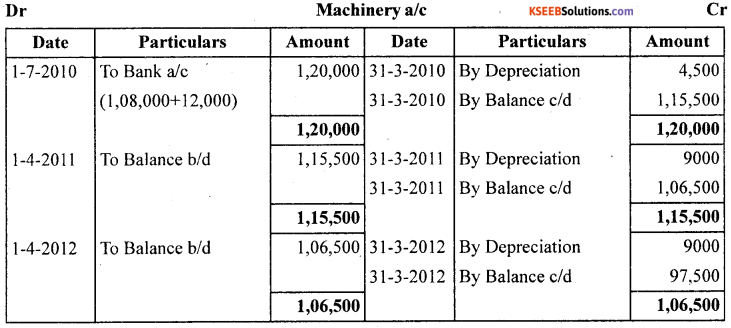

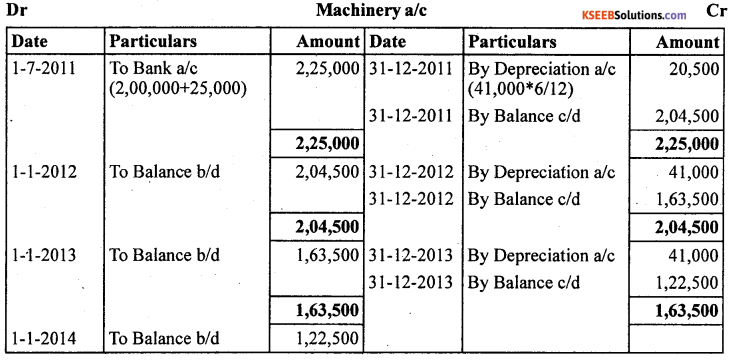

Question 2.

On July 01,2000, Ashok Ltd. Purchased a Machine for ₹ 1,08,000 and spent ₹ 12,000 on its installation. At the time of purchase it was estimated that the effective commercial life of the machine will be 12 years and after 12 years its salvage value will be ₹ 12,000.

Prepare Machine account and depreciation Account in the books of Ashok Ltd. For first three years, if depreciation is written off according to straight line method. The account are closed on December 31st, every year.

Answer:

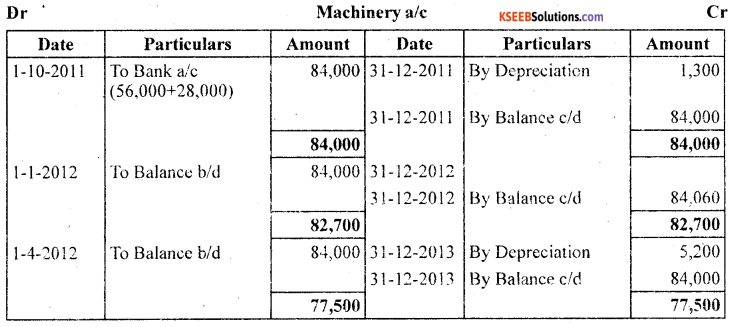

Question 3.

Reliance ltd. Purchased a second hand machine for ₹ 56,000 on October 01.2001 and spent ₹ 28,000 on its overhaul and installation before putting it to operation. It is expected that the machine can be sold for ₹ 6,000 at the end of its useful life of 15 years. Moreover an estimated cost of ₹ 1,000 is expected to be incurred to recover the salvage value of ₹ 6,000. Prepare machine account and Provision for depreciation account for the first three years charging depreciation by fixed installment Method. Accounts are closed on December 31, every year.

Answer:

![]()

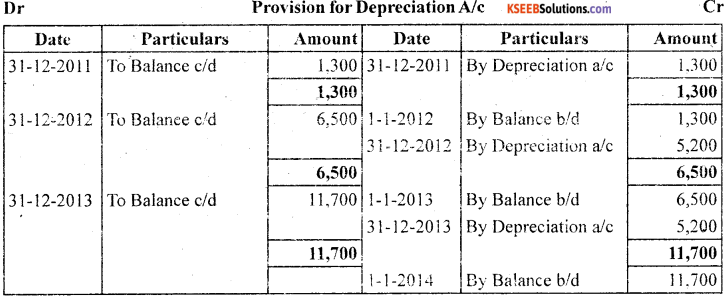

Question 4.

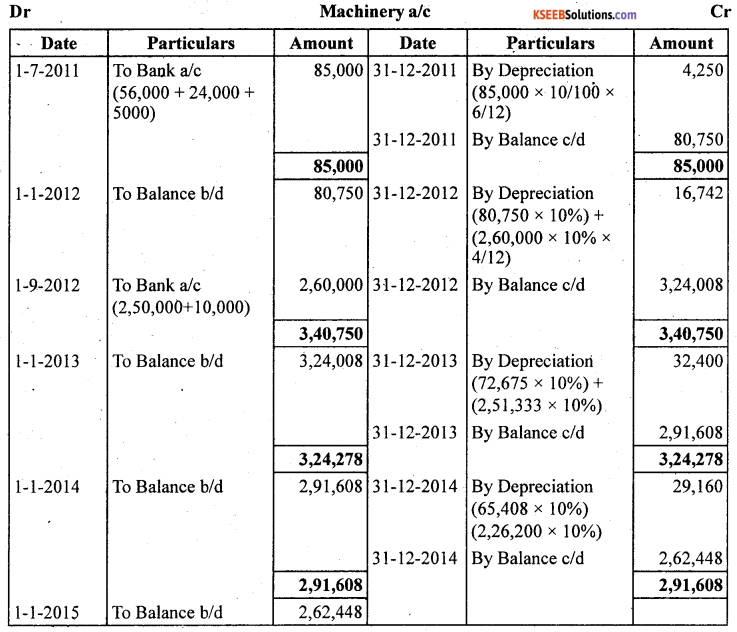

Berlia Ltd. Purchased a second hand machine for ? 56,000 on July 01.2001 and spent ₹ 24,000 on its repair and installation and ₹ 5000 for its carriage. On September 01.2002, it purchased another machine for ₹ 2,50,000 and spent ₹ 10,000 on its installation.

(a) Depreciation is provided on machinery @ 10% on original cost method annually on December 31, Prepare machinery account and depreciation account form the year 2001 to 2004.

(b) Prepare machinery7 account and depreciation account for the year 2001 to2004, if depreciation is provided on machinery @10% p.a. on written down value method annually on December 31.

Answer:

(a) Under Original Cost method

(b) Under Written down value method

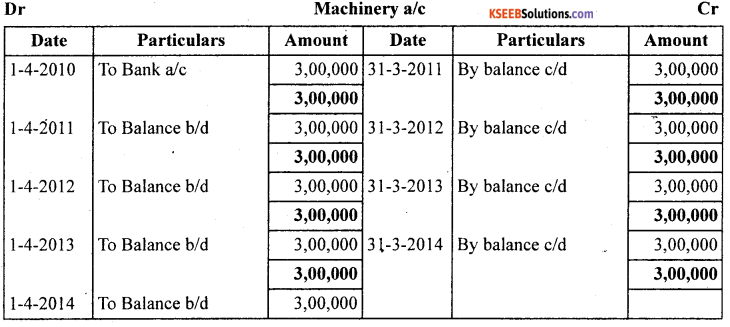

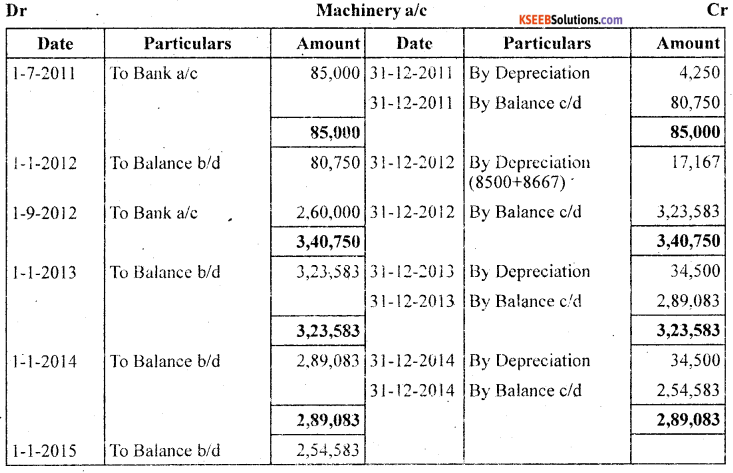

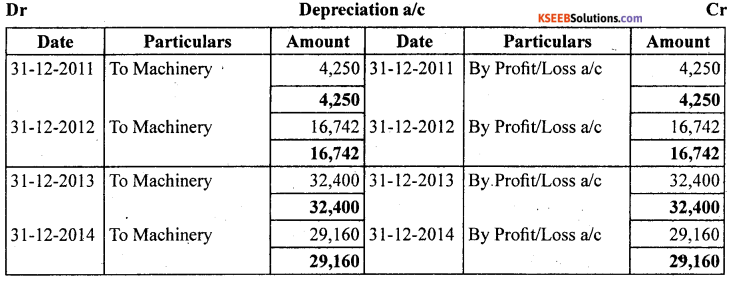

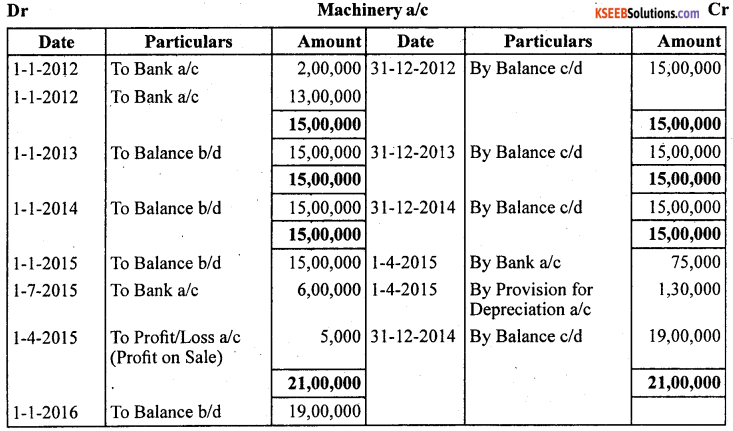

Question 5.

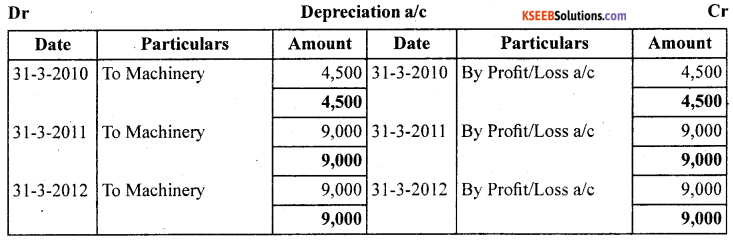

Ganga Ltd. Purchased a machinery on January 01.2001 for ₹ 5,50,000

And spent ₹ 50,000 on its installation. On September 01.2001 it purchased another machine for ₹ 3,70,000. On May 01,2002 it purchased another machine for ₹ 8,40,000 (including installation expenses).

Depreciation was provided on machinery @ 10% p.a. on original cost method annually on December 31, prepare

(a) Machinery account and depreciation account for the years 2001, 2002, 2003 and 2004.

(b) If depreciation is accumulated in provision for Depreciation account then prepare machine account and provision for depreciation account for the years 2001,2002, 2003 and 2004.

Answer

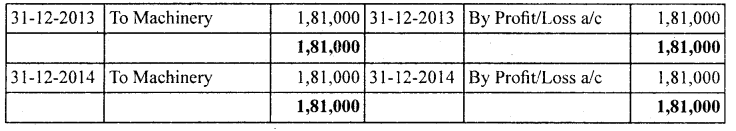

(b)

![]()

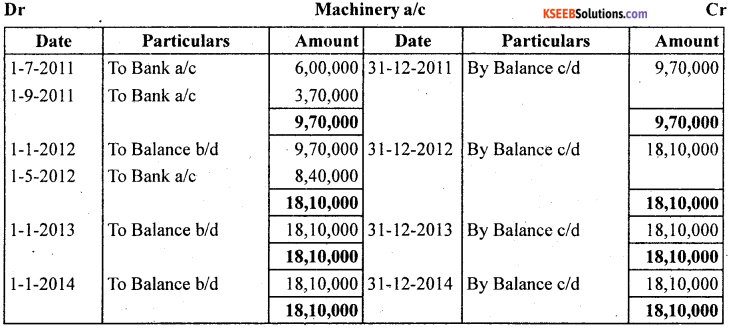

Question 6.

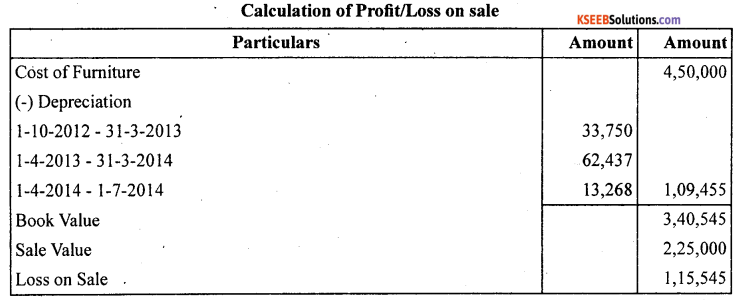

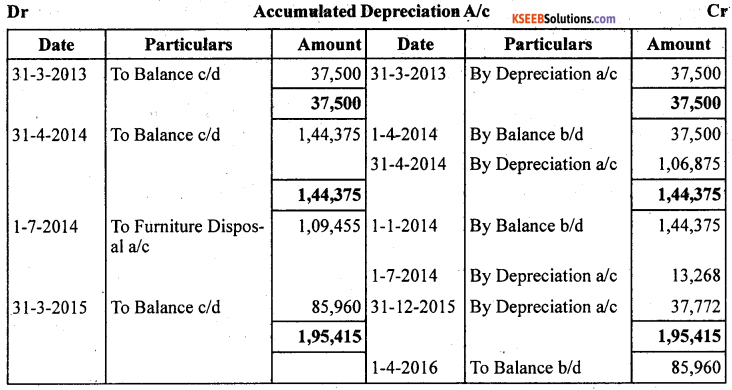

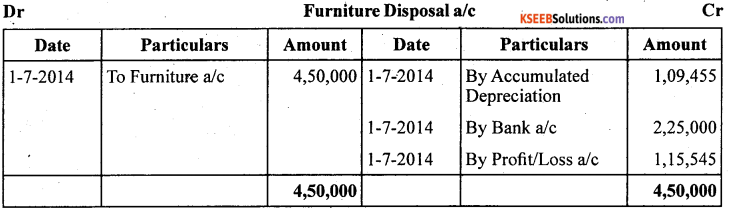

Azad Ltd. Purchased funiture On October 01.2002 for ₹ 4,50,000 on march 01.2003 it purchased another furniture for ₹ 3,20,000. On July 01.2004 it sold off the first furniture purchased in 2002 for ₹ 2,25,000. Depreciation is provided at 15% p.a. on written down value method each year. Accounts are closed each year on March 31. Prepare furniture account and accumulated depreciation account for the years ended on March 31,2003, Furniture disposal account is opened.

Answer:

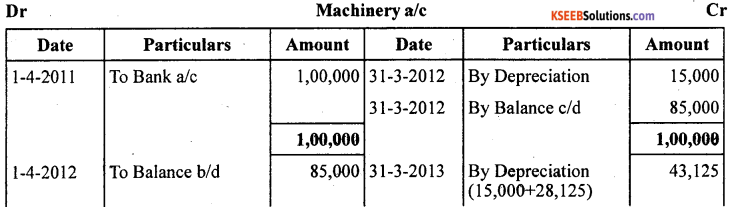

Question 7.

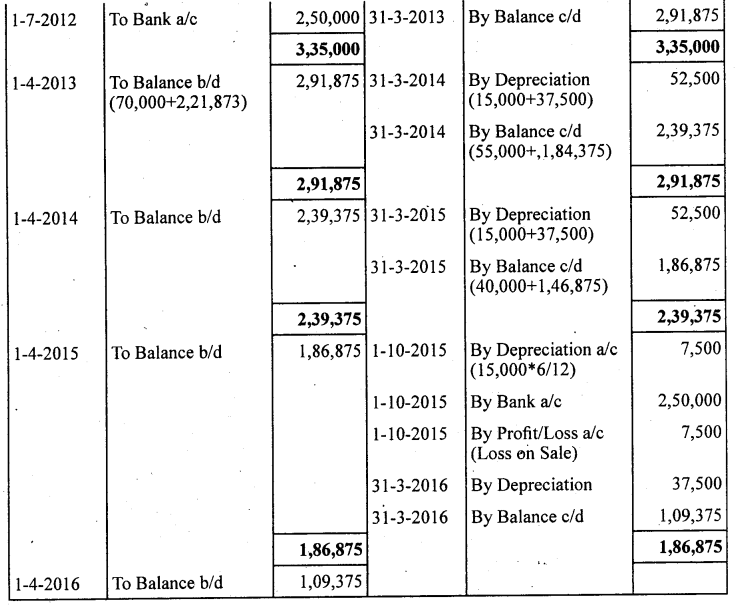

M/s Lokesh Fabrics purchased a Textile Machine on April 01. 2001 for ₹ 1,00,000. On July 01, 2002 another machine costing ₹ 2,50,000 was purchased. The machine purchased on April 01,2001 was sold for ₹ 25,000 on October 01.2005. The company charges depreciation @15% p.a. on straight line method. Prepare machinery account and machinery disposal account for the year ended March 31,2006.

Answer:

![]()

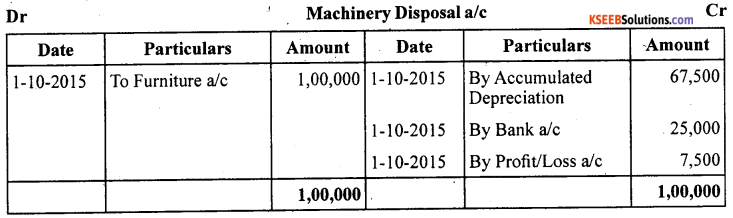

Question 8.

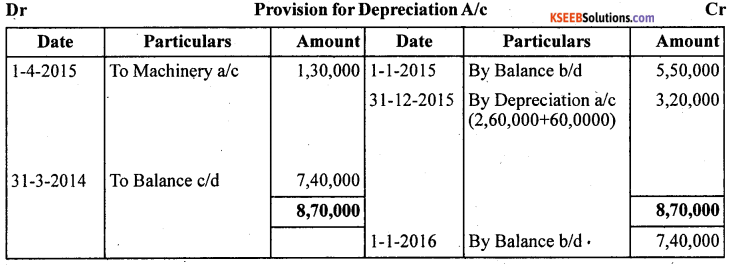

The following balances appear in the books of Crystal Ltd. On Jan 01,2005

Machinery account on 15,00,000

Provision for depreciation account 5,50,000

On April 01,2005 a machinery which was purchased on January 01.2002 for ₹ 2,00,000 was sold for ₹ 78,000. A new machine was purchased on July 01.2005 for ₹ 6,00,000 depreciation is provided on machinery at 20% p.a. on straight line method and books are closed on December 31 every year. Prepare the machinery account and provision for depreciation account for the year ending December 31 2005.

Answer:

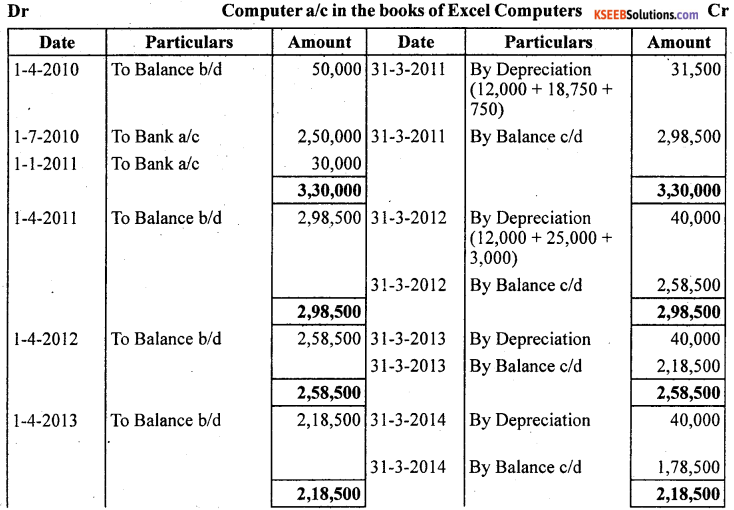

Question 9.

M/s Excel computers has a debit balance of ₹ 50,000: (original cost ₹ 1,20,000) in computers account on April 01.2000. on July 01. 2000 it purchased another computer costing ₹ 2,50,000. One more computer was purchased on January 01.2001 for ₹ 30,000. On April 01.2004 the computer which has purchased on July 01.2000 became obsolete and was sold for ₹ 20,000. A new version of the IBM computer was purchased on August 01.2004 for ₹ 80,000. Show computers account in the books of Excel computers for the years ended on March 31.2001,2002,2003,2004 and 2005. The computer is depreciated @ 10%p.a. on straight line method basis.

Answer:

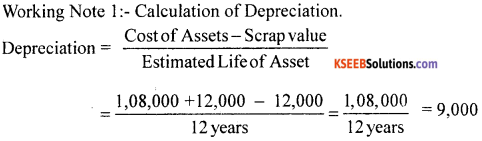

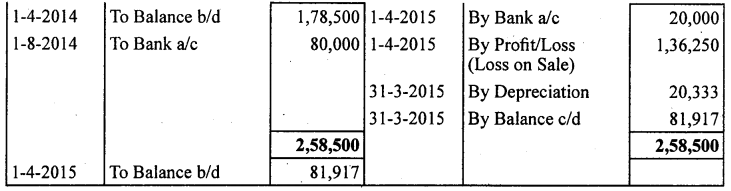

Question 10.

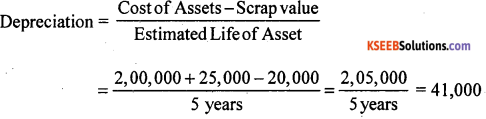

On July 01.2001 Ashwani purchased a machine for ₹ 2,00,000 on credit. Installation expenses ₹ 25,000 are paid by cheque. The estimated life is 5 years and its scrap value after 5 years will be ₹ 20,000. Depreciation is to be charged on straight line basis. Show the journal entry for the year 2001

Answer:

![]()

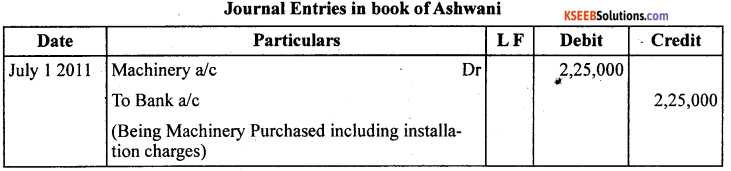

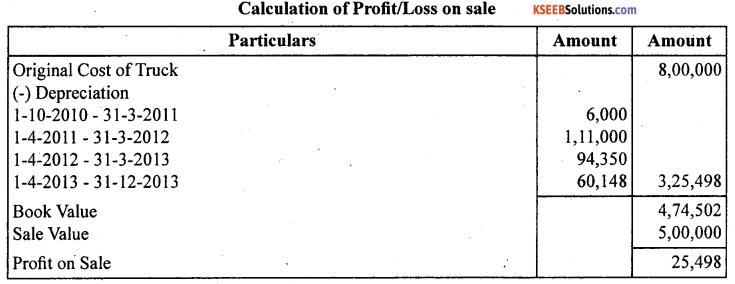

Question 11.

On October 01.2000, a Truck was purchased for ₹ 8,00,000 by Laxmi Transport Ltd. Depreciation was provided at 15% p.a. on the diminishing balance basis on this truck. On December 31. 2003 this Truck was sold for ₹ 5,00,000. Accounts are closed on 31st March every year. Prepare a Truck Account for the four years.

Answer:

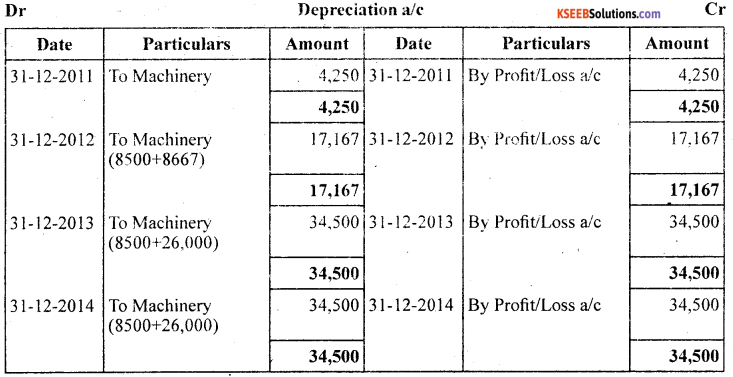

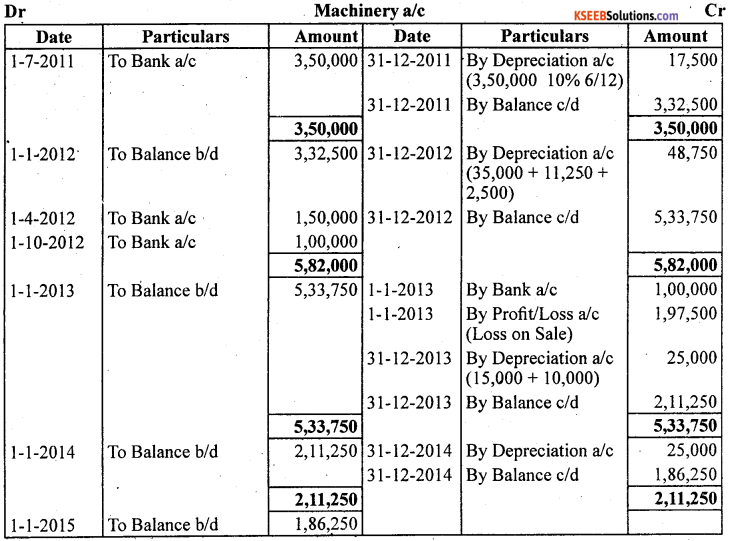

Question 12.

Kapil Ltd. Purchased a machinery on July 01, 2001 for ₹ 3,50,000. It purchased two additional machines, on April 01.2002 cost in ₹ 1,50,000 and on October 01.2002 costing Rs 1,00,000. Depreciation is provided @ 10% p.a. on straight line basis. On January 01.2003, first machinery become useless due to technical changes. This machinery was sold for ₹ 1,00,000. Prepare machinery account for 4 years on the basis of calendar year.

Answer:

![]()

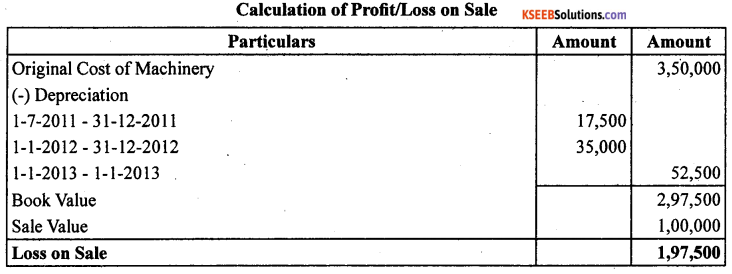

Question 13.

On January 01.2001, Satkar Transport Ltd, purchased 3 buses for ₹ 10,00,000 each. On July 01.2003, one bus was involved in as accident and was completely destroys and ₹ 7,00,000 were received from the Insurance Company in full settlement. Depreciation is written off @ 15% p.a. on diminishing balance method. Prepare bus account from 2001 to 2004. Books are closed on December 31 every year.

Answer:

Question 14.

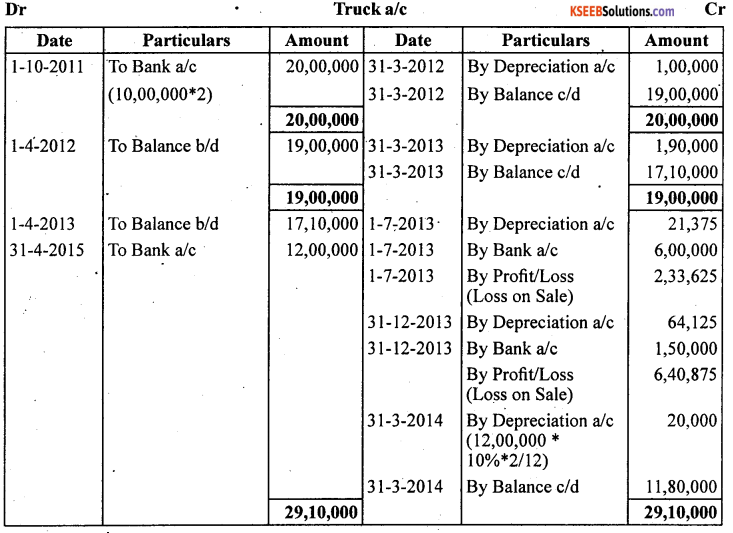

On October 01.2001 Juneja Transport Company purchased 2 trucks for ₹ 10,00,000 eash. ON July 01, 2003, One Truck was involved in as accident and was completely destroyed and ₹ 6,00,000 were received from the insurance company in full settlement. On December 31.2003 another truck was involved in an accident and destroyed partially, which was not insured. It was sold off for ₹ ’1,50,000. On January 31, 2004 company purchased a fresh truck for ₹ 12,00,000. Depreciation is to be provided at 10% p.a. on the written down value every year. The books are closed every year on March 31. Give the truck account from 2001 to 2004.

Answer:

Question 15.

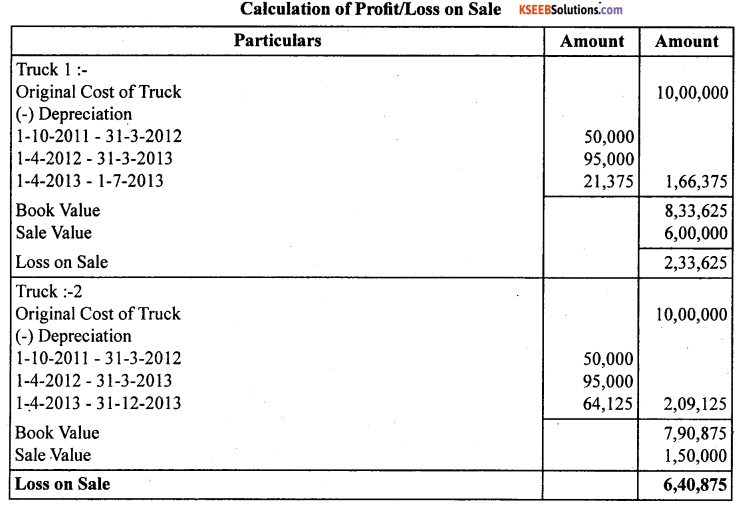

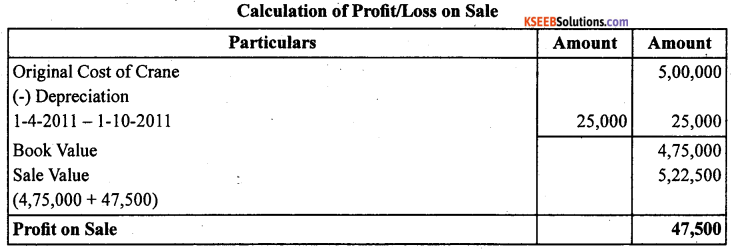

A Noida based Construction Company owns 5 cranes and the value of this asset in its books on April 01, 2001 is ₹ 40,00,000. On October 01, 2001 it sold one of its cranes whose value was ₹ 5,00,000 on April 01, 2001 at a 10% profit. On the same day it purchased 2 cranes for ₹ 4,50,000 each. Prepare cranes account. It closes the books on December 31 and provides for depreciation on 10% written down value.

Answer:

![]()

Question 16.

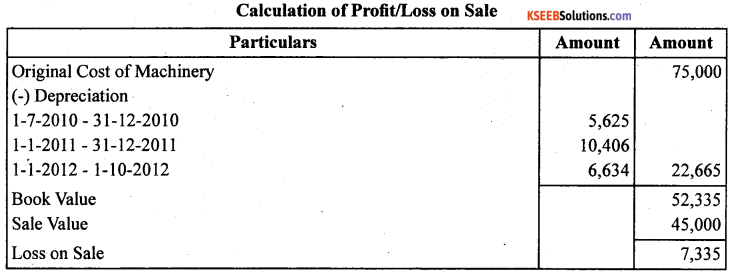

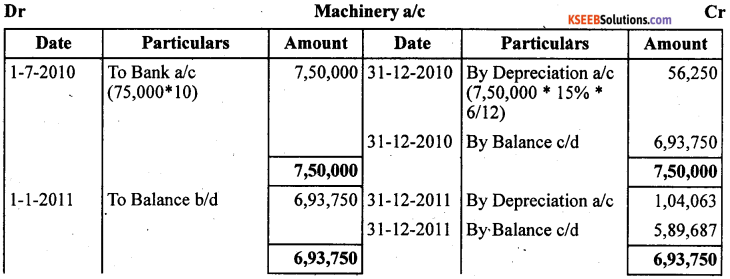

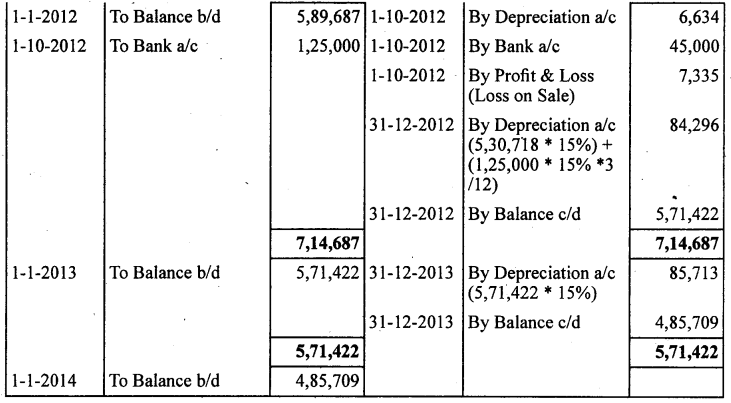

Shri Krishna Manufacturing Company purchased 10 machines for ₹ 75,000 each on July 01, 2000. On October 01,2002 one of the machines got destroyed by fire and an insurance claim of ₹ 45,000 was admitted by the company for ₹ 1,25,000.

The company writes off 15% p.a. depreciation on written down value basis. The company maintains the calendar year as its financial year. Prepare the machinery account from 2000 to 2003.

Answer:

Question 17.

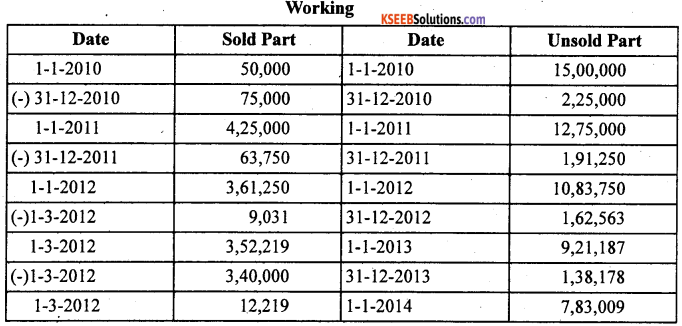

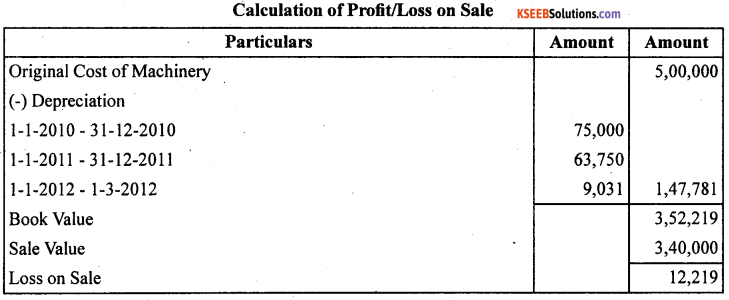

On January 01.2000, a limited company purchased machinery for ₹ 20,00,000. Depreciation is provided @ 15% p.a. on diminishing balance method. On March 01, 2002 one fourth of machinery was damaged by fire and ₹ 40,000 were received from the insurance company in full settlement. On September 01, 2002 another machinery was purchased by the company for ₹15,00,000.

Write up the machinery account form from 2002 to 2003. Books are closed on December 31, every year.

Answer:

![]()