Students can Download Economics Chapter 3 Liberalisation, Privatisation and Globalisation – An Appraisal Questions and Answers, Notes Pdf, 1st PUC Economics Question Bank with Answers helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka 1st PUC Economics Question Bank Chapter 3 Liberalisation, Privatisation and Globalisation – An Appraisal

1st PUC Economics Liberalisation, Privatisation and Globalisation – An Appraisal TextBook Questions and Answers

Question 1.

Why were reforms introduced in India?

Answer:

The economic crisis at the end 1980’s created more hurdles in the process of growth and development in India, hence it resulted with introduction economic reforms.

The causes for introducing new economic reforms are:

- The Government expenditure was more than its revenue.

- The current account deficit was more than 2.5%

- The fiscal deficit increased to 8.5%

- Inflation was also one of the main cause

- A sharp increase in imports caused decline in foreign exchange reserves.

Question 2.

Why is it necessary to become a member of WTO?

Answer:

The World Trade Organisation (WTO) was founded in 1995 as the successor to the General Agreement on Trade and Tariff (GATT). It is beneficial to become a member of WTO because of the following reasons:

1. Rule Based Trading:

WTO is formed to establish a rule based trading system in which arbitrary restrictions cannot be placed on trade by different nations. This helps in making the trade environment more stable.

2. Equality of Opportunities:

Under WTO, the member countries confer the status of Most Favoured Nation (MEN) to all other member countries. Thus, WTO provides equal opportunities to all countries in the international market for trading purposes.

3. Multilateral Negotiations:

The purpose of WTO is also to enlarge production and trade of services, to ensure optimum utilization of world resources and to protect the environment. The WTO agrements cover trade in goods as well as services to facilitate international trade through multilateral trade negotiations leading to removal of tariff as well as non tariflfbarriers.

This helps in providing greater market access to all member countries. However, some scholars question the usefulness of being a member of the WTO. They are of the view that while developed countries force the developing countries to open up their markets but do not allow access to their own markets. Similarly, developing countries are pressurized to remove non – tariff barriers such as subsidies but developed nations continue with them.

Question 3.

Why did RBI have to change its role from controller to facilitator of financial sector in India?

Answer:

The liberalisation policy paved the way to RBI to change its role from controller to facilitator of financial sector to enjoy freedom to take their decisions on several matters in India.

![]()

Question 4.

How is RBI controlling the Commercial Banks?

Answer:

The RBI controls the Commercial Banks through:

- The RBI decides the amount of money that the banks can keep with themselves.

- RBI fixes the interest rates

- Nature of lending to various sectors

- It safeguards the interests of account holders

- What do you understand by devaluation of rupee?

Devaluation of rupee means a deliberate downward adjustment in the official exchange rate of rupee relative to other currencies, Devaluation is different from depreciation which is a fall in the value of a currency in a floating exchange rate due to supply and demand side factors and not due to government decision.

Under floating exchange rate system as followed in India at present, the RBI maintains the exchanges rate of rupee by buying or selling foreign currency, usually US Dollar. There were two important implications of devaluation of rupee.

First devaluation made India’s exports relatively less expensive for foreigners and increased their competitiveness and second, it made foreign products relatively more expensive for domestic consumers, discouraging imports. As is evident, this was done to reduce India’s Balance of Payments (BoP) deficit.

Question 6.

Distinguish between the following :

- Strategic and Minority sale

- Bilateral and Multi – lateral trade

- Tariff and Non – tariff barriers.

Answer:

Difference between Strategic and Minority Sale.

| Sl. No. | Strategic Sale | Minority Sale |

| i) | Strategic sale involves the sale of minimum 51 % of a Public Sector Unit (PSU) to the private sector. | Minority sale involves the sale of less than 49% stake of a PSU to the private sector. |

| i) | The control and management of PSU is transferred to the private sector. | The control and management of PSU remains with the government as it holds the majority stake. |

| iii) | It is done through a process of competitive bidding and subsequent sales to the partner. | Minority disinvestment are made via public offers. |

Bilateral and Multi – lateral trade

| Sl. No. | Bilateral Trade | Multi-lateral Trade |

| i) | It is a trade agreement between two countries. | It is a trade agreement among more than two countries |

| ii) | Separate negotiations required to be done with different countries on one to one basis. | Negotiations done with many countries together which saves time. |

| m) | Encourages economic cooperation bet when two countries. | Encourages globalisation integrating many countries of the world |

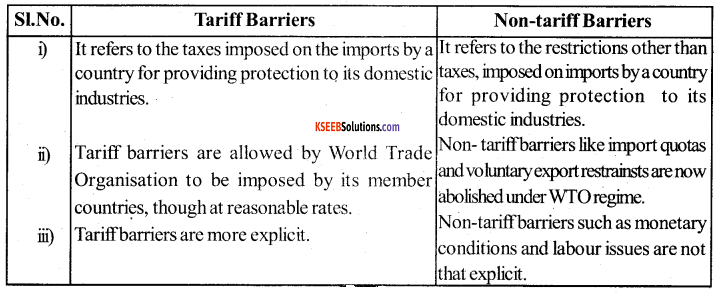

Tariff and Non – tariff barriers.

Question 7.

Why are Tariffs imposed?

Answer:

Tariffs are imposed to make imports from foreign countries relatively expensive than domestic goods. This discourage imports and protect domestically produced goods.

Question 8.

What is the meaning of Qualitative Restrictions?

Answer:

Qualitative restrictions are specific limits imposed by countries on the quantity or value of goods that can be imported or exported.

![]()

Question 9.

Those public sector undertakings which are making profits should be privatized. Do you agree with this view? Why?

Answer:

The PSU’s (Public Sector Undertakings) which are making profits should not be privatized because they are revenue generator for the Government. But if a PSU is an inefficient and loss making one, then the same PSU exerts unnecessary burden on the Government’s scare revenues and further may lead to budget deficit. The loss making PSU’s should be privatised.

Further some of the PSU’s like waterways, railways enhance the welfare of nation and is meant to serve general public at a very nominal cost. Privatisation of such important PSUs will lead to loss of welfare of poor people. Hence only less important PSUs should be privatised while leaving the core and important PSUs to be owned by the public sector.

Instead of privatisation of profit making PSU’s Government can allow more degree of autonomy and accountability in their operations, which will not only increase their productivity and efficiency but also enhance their competitiveness with their private counterparts.

Question 10.

Do you think outsourcing is good for India? Why are developed countries opposing it?

Answer:

Outsourcing is one of the important outcomes of the globalisation process. In outsourcing, a company hires regular services from external sources, mostly from other countries. Many of the services such as voice-based business processes, record advice, etc are being outsourced by companies in developed countries to India. Therefore, outsourcing has proved to be good for India in the following manner.

1. Employment Generation :

Outsourcing from developed nations has helped in creating more employment opportunities in India. It has resulted in generation of higher paying jobs that utilize the skills of educated youth of India.

2. Increased Foreign Investment:

Successful execution of processes outsourced to India has increased India’s international credibility and hence the inflow of foreign capital to India.

3. Promotes:

Other sectors outsourcing creates various backward and forward linkages which make it beneficial for other related sectors like industrial and agricultural sectors too.

4. Human Resource Development:

Outsourcing has helped in developing human resources by draining the youth and imparting skills required for specific jobs that have high remuneration.

5. Rise in Standard of Living :

Outsourcing has improved the standard of living of the people in India by generating more and better employment with rise in average salaries. Outsourcing is beneficial for India but developed countries oppose this because outsourcing leads to the outflow of capital from the developed countries to the developing countries, further, outsourcing leads to a reduction in employment in the developed countries as the same jobs are outsourced to the developing countries where these are done at relatively cheap wage rates.

Question 11.

India has certain advantages which makes it a favorite outsourcing destination. What are these advantages?

Answer:

Most multinational corporations, and even small companies, are outsourcing their services to India as India has the following advantages.

1. Availability of Cheap Labour:

India is a country with a large population and thus abundant supply of labour. Due to this reason, labour in India is available at low wage rates. This helps foreign companies in reducing cost of operation by outsourcing their business processes of India.

2. Skill and Accuracy:

India has a wide pool of talent in the form of educated and trained youth who have the required skill and can work with accuracy in the business processes such as accounting, record keeping, I.T. consultancy, etc. Here outsourcing plays a vital role, it gives a platform to the people so that they can use and enhance their skills and secondly they need low training period and thus, low cost of training.

3. Continuity and Risk Management:

Periods of high employee turnover will add uncertainty to the operations. Outsourcing those functions become cheaper and convenient to use.

Question 12.

Do you think the Navarathna policy of the Government helps in improving the performance of public sector undertakings in India? How?

Answer:

The Government has decided to give special treatment to some of the important profit-making PSUs. The granting of Navaratna status resulted in better performance of these companies. They were given greater managerial and operational autonomy.

In taking various decisions to run the company efficiently and thus increase their profits they also became highly competitive and some of them are becoming the giant global players. Therefore the Navarathna policy has certainly improved the performance of the PSU’s.

Question 13.

What are the major factors responsible for the high growth of the service sector?

Answer:

There are various factors which are responsible for the high growth of the service sector.

1. Reforms introduced in 1991, removes various restrictions on the movement of international finance which led to huge inflow of foreign capital, foreign direct investments, and outsourcing to India. This encouraged the service sector growth.

2. Availability of cheap labour and skilled labour at lower wage rate.

3. The revolution in information technology(IT) field in India has also played a major role in the high growth of the service sector.

4. Indian economy is experincing structural transformation that implies shift of economic dependence from primary to tertiary sector.

Question 14.

The agriculture sector appears to be adversely affected by the reform process. Why?

Answer:

The economic reforms of 1991 have not been able to benefit agriculture, where the growth rate has been decelerating. The reasons are:

1. Public investment in agriculture sector, especially in infrastructure, which includes irrigation, power, roads, market linkages and research and extension, have been reduced in the reform period.

2. Removal of subsidies on fertilizers pushed up the cost of production of agriculture. This made farming more expensive, thereby, adversely affecting the poor and marginal farmers.

3. Since the commencement of WTO, this sector has been experiencing a number of policy changes such as reduction in import duties on agricultural products, removal of minimum support price and lifting of quantitative restrictions on agricultural products.

4. They have to face international competition. Further, export oriented policy strategy in agriculture has encouraged the farmers to enter export market and take up the cultivation of cash crops. This has led to rise in prices of food grains.

Question 15.

Why has the industrial sector performed poorly in the reform period?

Answer:

The industrial sector has performed poorly in the reform period due to :

- The cheaper imports of foreign goods have replaced the demands of domestic goods.

- Due to lack of infrastructure, the domestic firms could not compete with their developed foreign counterparts in terms of cost of production and quality of goods.

- Developing countries like India still do not have access to global markets of developed countries due to high non-tariffbarriers.

The domestic industries were given protection during the pre-liberalised period but at the time of liberalisation, the domestic industries were still not developed up to the extent it was thought and consequently they could not complete with the multi-national companies.

![]()

Question 16.

Discuss economic reforms in India in the light of Social Justice and Welfare?

Answer:

If the economic reforms have given us an opportunity in terms of greater access to global markets and high technology, it has also compromised the welfare of people belonging to poorer section.

It devasted the local producers as well as the farmers. It resulted in the greater inequalities of income and wealth.

Further, the economic reforms developed the areas that were well connected with the metropolitan cities leaving the remote and rural area underdeveloped. It resulted in growth of service sector of India especially in the form of quality education, superior health care facilities, IT (Information Technology), Tourism, multiplex, cinemas, etc., which were out of the reach of the poor section of the population.

Globalisation has given an opportunity to choose variety of goods at cheaper prices. There has been a revolution in telecommunication.

1st PUC Economics Liberalisation, Privatisation and Globalisation – An Appraisal Additional Questions and Answers

1st PUC Economics Liberalisation, Privatisation and Globalisation – An Appraisal Very Short Answer Type Questions

Question 1.

What is meant by Liberalisation?

Answer:

Liberalisation is the process of removing the Government control and restrictions on economic activities.

Question 2.

State the meaning of devaluation of rupee?

Answer:

The deliberate reduction of the value of rupee against foreign currencies is called devaluation of rupee.

Question 3.

Expand IMF?

Answer:

International Monetary Fund.

Question 4.

Expand IBRD?

Answer:

International Bank for Reconstruction and Development.

Question 5.

What is Direct Tax?

Answer:

The direct tax is the tax which is imposed by the Government on individuals and companies and which cannot be shifted to others.

Question 6.

Give any two examples for Direct Taxes?

Answer:

The two examples for direct taxes are :

- Income Tax

- Corporation Tax

- Wealth tax

Question 7.

What is Indirect Tax?

Answer:

Indirect taxes are those in which tax burden is transferred to others. They are levied on goods and services.

Question 8.

Give any two examples for Indirect Taxes?

Answer:

The two examples for indirect taxes are:

- Sales Tax

- Service Tax

- Value Added Tax (VAT).

Question 9.

What is Tariff?

Answer:

Tariff is a tax which is imposed by the Government on imported goods and tariff is levied to restrict import trade and to protect domestic industries.

Question 10.

Give the meaning Foreign Exchange?

Answer:

Foreign exchange refers to exchange of one currency for another or the conversion of one currency into another currency.

Question 11.

Give the meaning of Exports?

Answer:

Exports is a process where all domestic goods are sold to other countries to gain more profits.

Question 12.

Give the meaning of Imports?

Answer:

Import is a process where the goods are purchased from other countries for the benefit of individuals in domestic country.

Question 13.

What is Globalisation?

Answer:

Globalisation means opening up of the country’s economy for the world market.

OR

It simply means greatest integration between different economies of the world.

Question 14.

What is Privatisation?

Answer:

Privatisation refers to transfer of ownership or management of public enterprises to private people.

![]()

Question 15.

What do you mean by Outsourcing?

Answer:

Outsourcing is a process where a company hires regular service from external sources, mostly from other countries.

Question 16.

Expand GATT?

Answer:

General Agreement on Tariffs and Trade.

Question 17.

Expand WTO?

Answer:

World Trade Organisation.

Question 18.

When did GATT came into existence?

Answer:

The GATT came into existence in 1948.

Question 19.

In which year WTO came into existence?

Answer:

The WTO came into existence on 1st January 1995.

Question 20.

What is the main objective of the WTO?

Answer:

The main objective of the WTO is to establish a rule based trade regime to ensure optimum utilisation of world resources.

Question 21.

When was the economic reform programme introduced in the Indian economy?

Answer:

The economic reforms programme was introduced in the Indian economy in 1991.

Question 22.

Write down the components of the New Economic Policy?

Answer:

The components of New Economic Po Hey are:

- Liberalisation

- Privatisation

- Globalisation

![]()

Question 23.

What does foreign direct investment mean?

Answer:

It refers to investment directly undertaken by foreign companies and nationals in various sector of the economy.

Question 24.

What are the main features of economic reforms?

Answer:

The main features of economic reforms are:

- Changes in fiscal policy

- Changes in monetary exchange,

- And changes in wage income policy and reforms in trade policy

- Industrial PO hey ……..

- Public sector

- Administered prices and tariff policy.

Question 25.

Which economic system has India adopted?

Answer:

India has adopted mixed economic system.

Question 26.

What is mixed economy?

Answer:

When all the economic activities which will be owned and managed by both the Government and private sector is called as mixed economy.

Question 27.

How is the new economic policy classified?

Answer:

The new economic policy classified into two groups namely:

- Stabilisation measures &

- Structural adjustment reform measures.

Question 28.

Expand LPG ?

Answer:

The LPG stands for liberalisation, privatisation, and globalisation in new economic policy introduced in 1991.

Question 29.

Expand GST?

Answer:

Good and Service Tax.

Question 30.

What are the main objectives of Privatisation?

Answer:

The main objective of privatisation was:

- To improve financial discipline

- To improve raise the productive efficiency

- To facilitate modernization.

Question 31.

Mention any two benefits of Globalization?

Answer:

The two benefits of Globalization was:

- Globalisation attracted foreign direct investment.

- Globalisation created more employment opportunities

- Globalisation brought technical expertise to our country.

Question 32.

Give any two areas where outsourcing is done in India?

Answer:

In India, the outsourcing is done in business areas like:

- Legal advice

- Computer service

- Advertisement

- Security etc.,

Question 33.

Expand BPO ?

Answer:

Business Process Outsourcing.

1st PUC Economics Liberalisation, Privatisation and Globalisation – An Appraisal Short Answer Type Questions

Question 1.

What are the major reforms of financial sector?

Answer:

The major reforms of financial sector are:

- The reform policies led to the establishment of new private sector banks.

- Even foreign banks are allowed to function in the country.

- The commercial banks have been given freedom to open new branches on fulfilling certain conditions.

- Foreign investment limit in bank was raised to 50percent.

Question 2.

Why has the Government removed trade barriers?

Answer:

Since 1991 the Government removed trade barriers because :

- To make Indian producers compete with producers across the world.

- The Government felt that competition would improve the quality and performance of producers within the country.

- To liberalize foreign trade and investment.

- To increase the volume of Foreign Direct Investment.

Question 3.

Do you think FDI is necessary for India? why?

Answer:

The FDI is necessary for India because :

- FDI also helps in bringing technical expertise to our country.

- FDI also helps in access to foreign markets.

- FDI is also helpful to increase more employment opportunities.

Question 4.

Distinguish between the following.

Answer:

- Strategic and minority sale

- Bilateral and minority sale

- Tariff and non-tariff barriers.

![]()

Question 5.

What do you mean by structural adjustment programmes? Name any two them.

Answer:

The structural adjustment programmes are those which bring structural change in the economy and improve its productivity. And these structural adjustment programmes are:

- Industrial sector reforms

- Trade reforms &

- Public sector reforms etc.,

Question 6.

Do you think outsourcing is helpful for India?

Answer:

Yes, outsourcing is helpful to India. Outsourcing has intensified with the growth of information technology.

- It helps our country to get valuable foreign exchange to cover imports.

- And it helps in creation ofmore employment opportuni ties.

Question 7.

Why are small scale industries facing severe problems in India since 1991?

Answer:

- There was decline indeman for domestic industrial products due to cheaper imports.

- Domestic industries had to face foreign competition

- Globalisation affected domestic industries and employment opportunities.

- Hundred’s of SSI’s all over India were closed.

Question 8.

What are the major factors responsible for the high growth of the service sector?

Answer:

There are various factors which are responsible for the high growth of the service sector.

- Reforms introduced in 1991, removes various restriction on the movement of international finance which led to huge inflow of foreign capital foreign direct investments and outsourcing to India. This encouraged the service sector growth.

- Availability of cheap labour and skilled labour at lower wage rate.

- The revolution in Information Technology(IT) field in India has also played a major role in the high growth of the service sector.

- Indian economy is experiencing structural transformation that implies shift of economic dependence from primary to tertiary sector.

Question 9.

Name any four public sector industries?

Answer:

- ONGC – Oil and Natural Gas Corporation.

- NTPC – National Thermal Power Corporation.

- BHEL – Bharath Heavy Electrical Limited BEL – Bharath Electronics Limited.

Question 10.

Mention any four Trade Policy Reforms introduced in India?

Answer:

The four trade policy reforms are as follows :

- Removal of quantitative restrictions on imports and exports.

- Reforms were introduced to remove trade barriers and liberalize foreign trade and investment.

- Tariff rates have been reduced.

- Exports restrictions have been liberalized and export duties have been reduced.

Question 11.

India has certain advantages which makes it a favourite outsourcing destination. What are these advantages?

Answer:

The advantages which make it a favourite out souring destination are :

- Easy availability of cheap labour. As the wage rates in India are comparatively lower than that of in the developed countries.

- Skills – Indians have reasonable degree of skills and techniques and knowledge of International language, English.

- Stable Political Environment: The democratic political environment in India provides a stable and secured environment to the MNC’s to expand and grow.

- Availability of raw material at cheaper rate India is well downed in natural resources. This ensures the MNC’s cheap availability of raw material and undisturbed and perennial supply of raw materials. This enables proper and smooth operation of MNC’s.

Question 12.

What are the monetary reforms under the New Economic Policy?

Answer:

Monetary measures play an important role in the development of a country. Under the’ new economic policy, several steps have been taken.

On the recommendations of Narasimham Committee:

- Abolition of direct credit programmes

- Free determination of interest rate

- Reconstitution of banking system

- More freedom to banks

- Improvement in banking system

- Reduction in liquidity ratio.

![]()

Question 13.

What are the causes of Globalisation?

Answer:

The main causes of Globalisation are as follows:

- Rapid growth of research and development.

- Removal of artificial barriers to the movement of goods, services, and capital.

- Spread out of the manufacturing processes by large companies.

- Deregulation of money market.

- Improvement in communication media and information technology.

Question 14.

Write down the foreign currency of the following data

Answer:

1st PUC Economics Liberalisation, Privatisation and Globalisation – An Appraisal Long Answer Type Questions

Question 1.

Explain the background of economic reforms in India?

Answer:

The origin of financial crisis of Indian economy goes back to 1980’s. The Government expenditure exceeded its revenue. This forced the Government to borrow from public, banks and from international financial institutions. On the other hand, the Government had to spend its revenue to meet the problems like unemployment, poverty and population explosion.

The development programmes of the Government did not generate additional revenue from taxation. The income from public sector undertakings was insufficient. At times, the external borrowing was spent on meeting consumption needs. Sufficient attention was not given to reduce such expenditure and boost our exports to pay for the growing imports.

In the late 1980’s the Government expenditure started exceeding its revenue by huge margin. Even the borrowings were not enough to meet expenditure. Fiscal deficit rose to 8.5 percent of GDP.

Current account deficit in external balance rose to 2.5 percentage, rise in prices of essential goods, sharp increase in imports, sharp decline in foreign exchange reserves, erosion of international confidence etc., were other major problems.

India approached World Bank and International Monetary Fund (IMF) for loan. The country receives 7 billion as loan to manage the crisis.

These international agencies laid down certain conditions for loan. India was directed to liberalise and open up the economy. This was be achieved through removal of restrictions on the private sector, reducing the role of the Government in many areas and removal of restrictions in foreign trade.

India agreed to the conditions laid down by the World Bank and International Monetary Fund. The then prime minister Shri. P. V.Narasimha Rao and finance minister Dr.Man mohan Singh formulated a package of economic policy reforms. The new economic policy (NEP) was announced in July 1991.

It consisted wide range of economic reforms. The main thrust of the policy was to create a more competetive environment in the economy and removing the barriers to entry and growth of firms.

![]()

Question 2.

Explain the liberalization measures introduced in Industrial and Financial Sectors since 1991?

Answer:

The important areas where liberalisation measures were introduced in and after 1991 are given below:

a. Deregulation of Industrial Sector:

Industrial Sector was the first to attract the attention of the reforms. The reforms introduced

in and after 1991 removed restrictions which were prevailing in this sector. Industrial licensing was abolished for all industries except for few industries related to

- security

- strategy and

- environmental concerns.

The number of industries reserved for the public sector have been reduced from 17 to 2. The only two industiy which are now reserved for the public sector are

- atomic energy generation aid

- railway transport.

The Government left all other industries to private sector.

b. Financial Sector Reforms:

Financial Sector includes financial institutions such as commercial banks, investment bank, stock exchange operations and foreign exchange market. This sector is controlled by the RBI, through various norms and regulations. One of the major aims of the financial sector reforms is to reduce the role of RBI from regulator to take their own decisions on several matters. Banks are given freedom to their own interest rates.

c. Tax Reforms :

Tax reforms relate to reforms in Government’s taxation and public expenditure policy (fiscal policy). Taxes are of two types, namely,

- Direct taxes

- Indirect taxes

d. Foreign Exchange Reforms:

The deliberate reduction of the value ofrupee against foreign currencies is called devaluation of rupee. This devaluation the prices of exports and at the same time, it increased the prices of imports this increases exports and reduce imports.

In 1991 as an immediate measure to resolve the balance of payments crisis, the rupee was devalued against foreign currencies. This led to increase in exports and in flow of foreign exchange

e. Reforms in Trade and Investment:

Tax on imports is one type of trade barriers. If the Government could place a limit on the number of goods that can be imprisoned, this is know as quotas. It is another type of barrier. Governments can use trade barriers to increase or decrease foreign trade. Since independence, Indian Government has put barriers on foreign trade and foreign investment. This was considered as necessary to protect our producers from foreign competition.

Question 3.

Write a short note on outsourcing?

Answer:

One of the important outcomes of globalisation is ‘outsourcing’. In outsourcing, a company hires service from external sources, mostly from other countries. It was earlier provided internally or within the country.

Outsourcing has intensified with the growth of information technology (IT). Many services such as voice based business process (Business process outsourcing, banking services, music recording, film editing, clinical advice, teaching, etc., are being outsourced by companies in developed countries to India).

Many companies are outsourcing their services to India due to lower cost, better skill and accuracy. The availability of skilled manpower at lower wages nowadays has made India a destination for global outsourcing.

![]()

Question 4.

Mention any five financial sector Reforms of 1991.

Answer:

The major financial sector reforms introduced by Government of India in 1991 are as follows:

- The role of RBI was made to facilitator of financial sector to financial controller.

- Giving managerial autonomy to financial sector to take decisions.

- Promotional schemes to establish private sector banks both Indian & foreign.

- Increasing the foreign investment limit on banks to 50%

- No more nationalization of banks.

- Allowing the foreign institutional investors (Fils) like merchant bankers, mutual funds and pensions funds to invest in Indian financial market.

Question 5.

Write a note on Industrial Sector Reforms?

Answer:

1. Delicensing abolishing licensing system for starting industries which is applicable to all the industries but for products like alcohol, cigrates, hazardous chemicals, industrial explosives, electronics, aerospace and drugs and pharmaceuticals.

2. To reduce number of industries relating to public sector and allowing private sector invest. There are only three industries reserved for public sector namely

- production of defence equipments

- atomic generation

- railway transport

3. Dereserving the production of many products which meant for small scale industries.

4. Determination of prices of commodities produced by the industries through market forces i.e., demand and supply.

5. Following laissez faire policy i.e., minimizing the intervention of Government.

6. To increase and have liberalization of FDI.

Question 6.

Point out the Fiscal Policy Reforms (Tax Reforms).

Answer:

The fiscal policy reforms are the reforms introduced by the Government in respect of taxation, subsidies public borrowings etc., The major fiscal policy reforms are as follows:

- Continuous reduction in tax rates on individual income in order to prevent tax evasion.

- Gradual reduction of corporate tax.

- Reducing Government expenditure by reducing the size of administration in the Government.

- Reducing subsidies on food grains, chemical fertilizers, exports, etc.,

![]()

Question 7.

Increasing the tax revenue through bringing changes in Tax Structure.

- Reduce maximum rate of Income tax.

- To widen tax bases and introduce various schemes for small traders and re-traders.

- To introduce service tax all over the country.

- Proposal to introduced goods and service tax (GST) in place of VAT.

Question 8.

Write a note on Globalisation?

Answer:

Globalisation refers to opening up economy for the world trade is called globalisation. In simple words it refers to encouraging the domestic entrepreneurs to invest abroad and at the same time allowing foreign entrepreneurs to invest in India.

- Restriction is removed on the movement of goods, services capital and technology from other countries to India.

- To get identification and recognition to Indian economy in the world market.

- Approving and encouraging foreign direct investment into Indian economy.

- Approving and encouraging movement of latest technology, goods, and services from others. countries to Indian economy.