You can Download Chapter 4 Reconstitution of a Partnership Firm – Retirement/Death of a Partner Questions and Answers, Notes, 2nd PUC Accountancy Question Bank with Answers Karnataka State Board Solutions help you to revise complete Syllabus and score more marks in your examinations.

Karnataka 2nd PUC Accountancy Question Bank Chapter 4 Reconstitution of a Partnership Firm – Retirement/Death of a Partner

2nd PUC Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner NCERT Text Book Questions And Answers

2nd PUC Reconstitution of a Partnership Firm – Retirement/Death of a Partner Short Answer Questions With Answers

Question 1.

What are the different ways in which a partner can retire from the firm.

Answer:

The partner retire from the business for money reasons they are

- Insolvency

- Because of age factor

- Not interested to continue

- All other partner decided

Question 2.

Write the various matters that need adjustments at the time of retirement of a partners.

Answer:

The various accounting aspects involved on retirement or death of a partner are as follows:

- Ascertainment of new profit sharing ratio and gaining ratio;

- Treatment of goodwill;

- Revaluation of assets and liabilities;

- Adjustment in respect of unrecorded assets and liabilities;

- Distribution of accumulated profits and losses;

- Ascertainment of share of profit or loss up to the date of retirement/death;

- Adjustment of capital, if required;

- Settlement of the amounts due to retired/deceased partner;

![]()

Question 3.

Distinguish between sacrificing ratio and gaining tab. 218 Accountancy – Not-for-Profit Organisation and Partnership Accounts.

Answer:

|

Gain ratio |

Sacrificing |

| Acquried from retiring/decreased partner | Give one to new partner |

| It is calculated at the time retirement or death of partner | It is calculated at the time admission of a partner |

Question 4.

Why do firm reyaiuate assets and reassers their liabilities on retirement or on the event of death of a partner.

Answer:

At the time of retirement or death of a partner there may be some assets which may not have been shown at their current values. Similarly, there may be certain liabilities which have been shown at a value different from the obligation to be met by the firm. Not only that, there may be some unrecorded assets and liabilities which need to be brought into books.

As learnt in case of admission of a partner, a Revaluation Account is prepared in order to ascertain net gain (loss) on revaluation of assets and/or liabilities and bringing unrecorded items into firm’s books and the same is transferred to the capital account of all partners including retiring/deceased partners in their old profit sharing ratio.

Question 5.

Why a retiring/deceased partner is entitled to a share of goodwill of the firm.

Answer:

The retiring or deceased partner is entitled to his share of goodwill at the time of retirement” death because the goodwill has been earned by the firm with the efforts of all the existing partners. Hence, at the time of retirement/death of a partner, goodwill is valued as per agreement among the partners the retiring/deceased partner compensated for his share of goodwill by the continuing partners (who have gained due to acquisition of share of profit from the retiring/deceased partner) in their gaining ratio.

2nd PUC Reconstitution of a Partnership Firm – Retirement/Death of a Partner Long Answer Questions With Answers

Question 1.

Explain the modes of payment to a retiring partner.

Answer:

The outgoing partner’s account is settled as per the terms of partnership deed i.e., in lumpsum immediately or in various instalments with or without interest as agreed or partly in cash immediately and partly in installment at the agreed intervals. In the absence of any agreement, Section 37 of the Indian Partnership Act, 1932 is applicable, which states that the outgoing partner has an option to receive either interest @ 6% p.a. till the date of payment or such share of profits which has been earned with his/her money (i.e., based on capital ratio).

Hence, the total amount due to the retiring partner which is ascertained after all adjustments have been made is to be paid immediately to the retiring partner. In case the firm is not in a position to make the payment immediately, the amount due is transferred to the retiring Partner’s Loan Account, and as and when the amount is paid it is debited to his account.

Question 2.

How will you compute the amount payable to a deceased partner?

Answer:

The sum due to the retiring partner (in case of retirement) and to the legal representatives/ executors (in case of death) includes:

- credit balance of his capital account;

- credit balance of his current account(if any);

- his share of goodwill ;

- his share of accumulated profits (reserves);

- his share in the gain of revaluation of assets and liabilities;

- his share of profits up to the date of retirement/death;

- interest on his capital, if involved, up to the date of retirement/death; and

- salary/commission, if any, due to him up to the date of retirement/death.

The following deductions, if any, may have to be made from his share:

- debit balance of his current account(if any);

- his share of goodwill to be written off; if necessary;

- his share of accumulated losses;

- his share of loss on revaluation of assets and liabilities;

- his share of loss up to the date of retirement/death;

- his drawings up to the date of retirement/death;

- interest on drawings, if involved, up to the date of retirement/death.

Question 3.

Explain the treatment of goodwill at the time of retirement or on the event of death of a partner?

Answer:

The retiring or deceased partner is entitled to his share of goodwill at the time of retirement/ death because the goodwill has been earned by the firm with the efforts of all the existing partners. Hence, at the time of retirement/death of a partner, goodwill is valued as per agreement among the partners the retiring/ deceased partner compensated for his share of goodwill by the continuing partners (who have gained due to acquisition of share of profit from the retiring/ deceased partner) in their gaining ratio.

When goodwill does not appear in the books of the firm there are four ways in which the . retiring partner can be given the necessary credit for loss of his share of goodwill, these are as follows:

(a) Goodwill is raised at its full value and retained in the books as such: In this case, Goodwill Account is debited will its full value and all the partner’s (including the retired/deceased partner) capital accounts are credited in the old profit sharing ratio. The full value of goodwill will appear in the balance sheet of the reconstituted firm.

(b) Goodwill is raised at it’s full value and written off immediately: If it decided that goodwill should not be refrained and shown in the balance sheet of the reconstituted firm then, after raising goodwill at its value by crediting all the partners’ capital accounts (including that of the retired/ deceased partners, it should be written off by debiting the remaining partners in their new profit sharing ratio and crediting the goodwill account with its full value.

(c) Goodwill is raised to the extent of retired/deceased partner’s share and written off immediately: In this case goodwill account is raised only to the extent of retired/ deceased partner’s share by debiting goodwill account with the proportionate amount and credited only to the retired/deceased partner’s capital account. Thereafter, the remaining partners capital accounts are debited in their gaining ratio and goodwill account/credited to write it off.

(d) No goodwill account is raised at all in firm’s books: If it is decided that the goodwill account should not appear in firm’s books at all, in that case it is adjusted discretely, through partners capital accounts.

![]()

If value of goodwill already appearing in the books of the firm equals with the current value of goodwill, normally no adjustment is required because goodwill stands credited in the accounts of all the partners including the retiring one.

It may be noted that in all the above situations, goodwill appears in the balance sheet at its full value. In case it is decided by the partners that it should be written-off, fully or partially.

Hidden Goodwill: If the firm has agreed to settle the retiring or deceased partner by paying him a lump sum amount, then the amount paid to him in excess of what is due to him based on the balance in his capital account after making necessary adjustments in respect of accumulated profits and losses and revaluation of assets and liabilities, etc. shall be treated as his share of goodwill (known as hidden goodwill).

Question 4.

Discuss the various methods of computing the share in profits in the event of death of a partners.

Answer:

The accounting treatment in the event of death of a partner is similar to that in case of retirement of a partner, and that in case of death of a partner his claim is transferred to his executors and settled in the same manner as that of the retired partner. However, there is one major difference that, while the retirement normally takes place at the end of an accounting period, the death of a partner may occur any time.

Hence, in case of a death, his claim shall also include his share of profit or loss, interest on capital, interest on drawings (if any) from the date of the last Balance Sheet to the date of his death of these, the main problem relates to the calculation of profit for the intervening period (i.e., the period from date of the last balance sheet and the date of the partner’s death.

Since, it is considered cumbersome to close the books and prepare final account, for the period, the deceased partner’s share of profit may be calculated on the basis of last year’s profit (or average of past few years) or on the basis of sales.

2nd PUC Reconstitution of a Partnership Firm – Retirement/Death of a Partner Numerical Questions

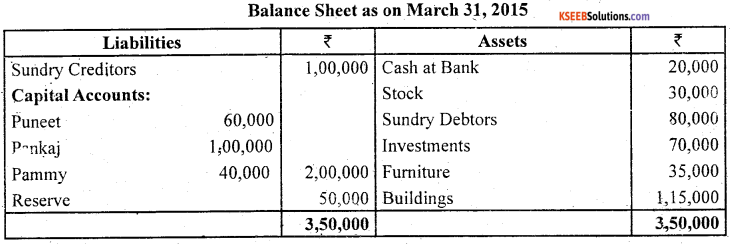

Question 1.

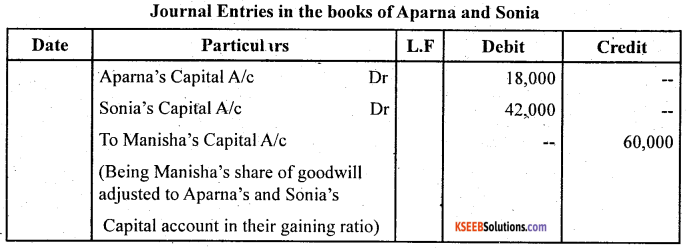

Aparna, Manisha and Sonia are partners sharing profits in the ratio of 3 : 2 : 1. Manisha retires and Goodwill of the firm is valued at ₹ 1,80,000. Aparna and Sonia decided to share future in the ratio of 3 : 2. Pass necessary journal entries.

Answer:

Working Notes :

1. Manisha’s share of goodwill:

Total goodwill of the firm × Retiring Partner’s Share, 1,80,000 × \(\frac { 1 }{ 3 }\) = 60,000

2. Gaining Ratio = New Ratio – Old Ratio

Aparna Gaining Share = \(\frac{3}{5}-\frac{3}{6}=\frac{18-15}{30}=\frac{3}{10}\)

Sonia Gaining Share = \(\frac{2}{5}-\frac{1}{6}=\frac{12-5}{30}=\frac{7}{30}\)

Gaining Ratio between Apama and Sonia = 3:7

3. Apama’s share in goodwill = 60,000 × \(\frac { 3 }{ 10 }\) = 18,000

Sonia’s share in goodwill = 60,000 × \(\frac { 7 }{ 10 }\) = 42,000

![]()

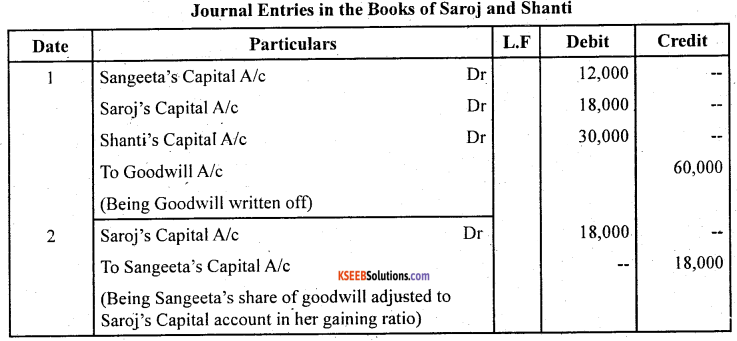

Question 2.

Sangeeta, Saroj and Shanti are partners sharing profits in the ratio of 2 : 3 : 5. Goodwill is appearing in the books at a value of ₹ 60,000. Sangeeta retires and goodwill is valued at ₹ 90,000. Saroj and Shanti decided to share future profits equally. Record necessary journal entries.

Answer:

Working Notes :

1. Sangeeta’s share of Goodwill.

Total Goodwill of the firm × Retiring Partner’s share ⇒ 90,000 × \(\frac { 2 }{ 10 }\) = 18000

2. Gaining Ratio ⇒ New Ratio – Old Ratio

Saro s Gaming Share = \(\frac{1}{2}-\frac{3}{10}=\frac{10-6}{20}-\frac{4}{20}\)

Shanti’s Gaining Share = \(\frac{1}{2}-\frac{5}{10}=\frac{10-10}{20}=\frac{0}{20}\)

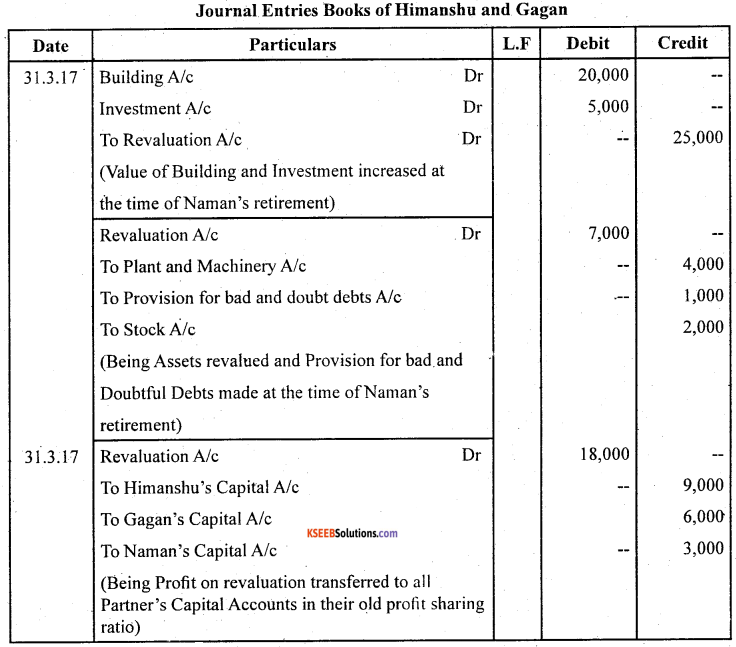

Question 3.

Himanshu, Gagan and Naman are partners sharing profits and losses in the ratio of 3 : 2 : 1. On March 31, 2017, Naman retires. The various assets and liabilities of the firm on the date were as follows:

Cash ₹ 10,000, Building ₹ 1,00,000, Plant and Machinery ₹ 40,000, Stock ₹ 20,000, Debtors ₹ 20,000 and Investments ₹ 30,000.

The following was agreed upon between the partners on Naman’s retirement:

- Building to be appreciated by 20%.

- Plant and Machinery to be depreciated by 10%.

- A provision of 5% on debtors to be created for bad and doubtful debts.

- Stock was to be valued at ₹18,000 and Investment at ₹ 35,000.

Record the necessary journal entries to the above effect and prepare the revaluation account.

Answer:

Question 4.

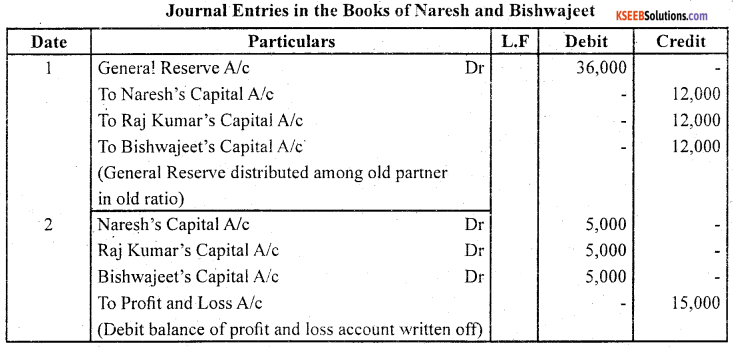

Naresh, Raj Kumar and Bishwajeet are equal partners. Raj Kumar decides to retire. On the date of his retirement, the Balance Sheet of the firm showed the following: General Reserves ₹ 36,000 and Profit and Loss Account (Dr.) ₹ 15,000.

Pass the necessary journal entries to the above effect.

Answer:

![]()

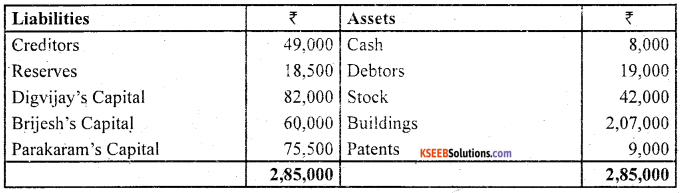

Question 5.

Digvijay, Brijesh and Parakaram were partners in a firm sharing profits in the ratio of 2:2:1. Their Balance Sheet as on March 31, 2007, was as follows:

Brijesh retired on March 31, 2007, on the following terms:

- Goodwill of the firm was valued at ₹ 70,000 and was not to appear in the books.

- Bad debts amounting to ₹ 2,000 were to be written off.

- Patents were considered as valueless.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of Digvijay and Parakaram after Brijesh’s retirement.

Answer:

Note: As sufficient balance is not available to pay the amount due to Brijesh, the balance of his capital account transferred to his loan account.

Working Note :

1. Brijesh’s share of goodwill

Total goodwill of the firm × Retiring Partner’s Share = 70,000 × \(\frac { 2 }{ 5 }\) = 28,000

2. Gaining Ratio = New Ratio – Old Ratio

Digvijay s = \(\frac{2}{3}-\frac{2}{5}=\frac{10-6}{15}=\frac{4}{15}\)

Parakaram’s = \(\frac{1}{3}-\frac{1}{5}=\frac{5-3}{15}=\frac{2}{15}\)

Gaining ratio between Digvijay and Parakaram = 4 : 2 or 2 : 1.

Question 6.

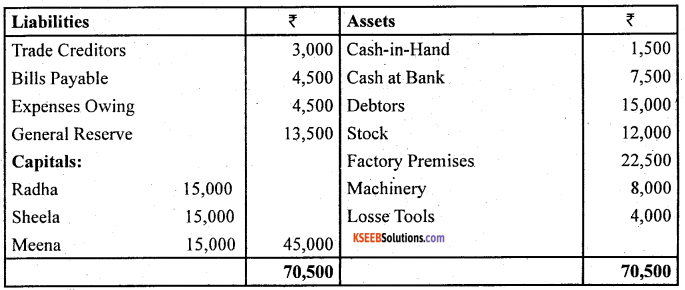

Radha, Sheela and Meena were in partnership sharing profits in the proportion of 3:2:1. On April 1, 2015, Sheela retires from the firm. On that date, their Balance Sheet was as follows:

The terms were:

(a) Goodwill of the firm was valued at ₹ 13,000.

(b) Expenses owing to be brought down to ₹ 3,750.

(c) Machinery and Loose Tools are to be valued at 10% less than their book value.

(d) Factory premises are to be revalued at ₹ 24,300.

Prepare:

1. Revaluation account

2. Partner’s capital accounts and

3. Balance sheet of the firm after retirement of Sheela.

Answer:

![]()

Question 7.

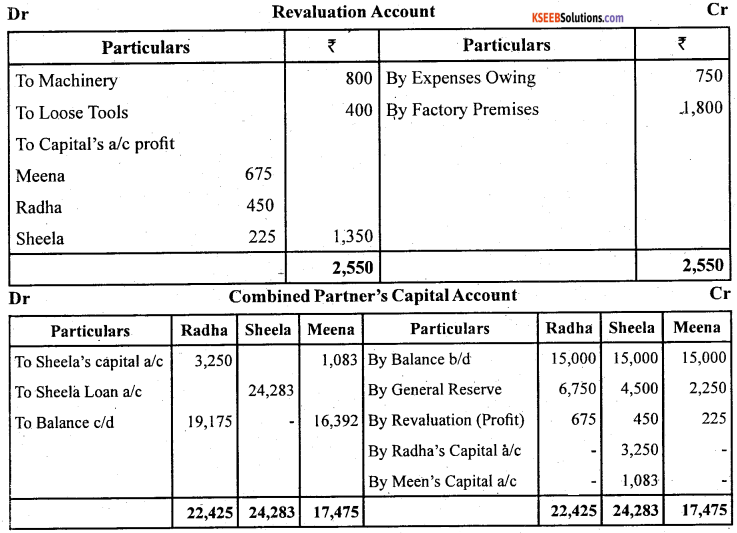

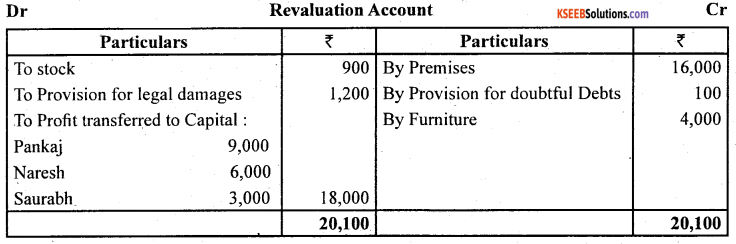

Pankaj, Naresh and Saurabh are partners sharing profits in the ratio of 3:2:1. Naresh retired from the firm due to his illness. On that date the Balance Sheet of the firm was as follows:

Books of Pankaj, Naresh and Saurabh

Additional Information

- Premises have appreciated by 20%, Stock depreciated by 10% and provision for doubtful debts was to be made 5% on debtors. Further, provision for legal damages is to be made for ₹ 1,200 and furniture to be brought up to ₹ 450.

- Goodwill of the firm be valued at ₹ 42,000.

- ₹ 26,000 from Naresh’s Capital account be transferred to his loan account and balance to be paid through bank; if required, necessary loan may be obtained form Bank.

- New profit sharing ratio of Pankaj and Saurabh is decided to be 5:1.

Give the necessary ledger accounts and Balance sheet of the firm after Naresh’s retirement.

Answer:

Question 8.

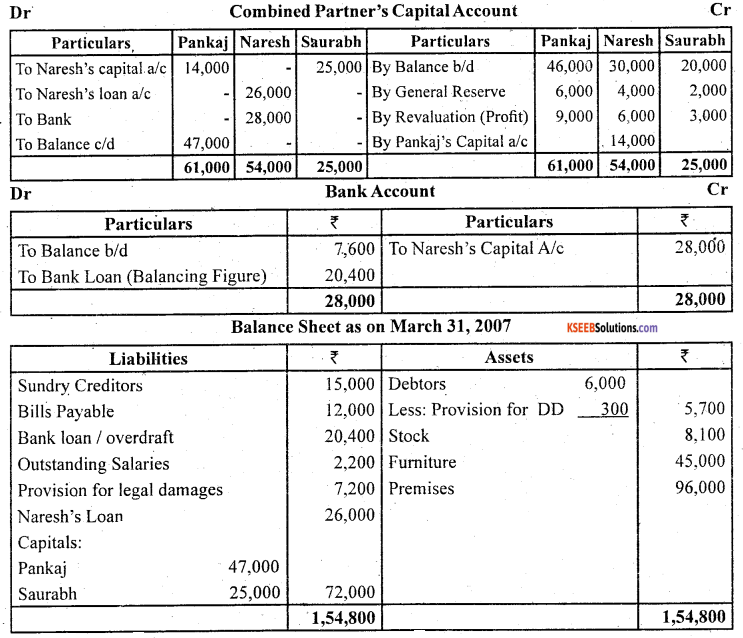

Puneet, Pankaj and Pammy are partners in a business sharing profits and losses in the ratio of 2:2:1 respectively. Their Balance sheet as on March 31, 2016, was as follows:

Mr. Pam my died on September 30, 2017. The partnership deed provided the following:

1.The deceased partner will be entitled to his share of profit up to the date of death calculated on the basis of previous year’s profit.

2. He will be entitled to his share of goodwill of the firm calculated on the basis of 3 years’ purchase of average of last 4 years’ profit. The profits for the last four financial years are given below:

for 2012-13; ₹ 80,000;

for 2013-14, ₹ 50,000;

for 2014-15, ₹ 40,000;

for 2015-16, ₹ 30,000.

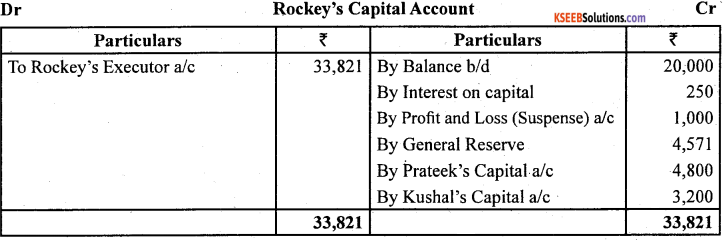

The drawings of the deceased partner up to the date of death amounted to ₹ 10,000. Interest on capital is to be allowed at 12% per annum. Surviving partners agreed that ₹ 15,400 should be paid to the executors immediately and the balance in four equal yearly instalments with interest at 12% p.a. on outstanding balance. Show Mr. Pammy’s Capital account, his Executor’s account till the settlement of the amount due.

Answer:

![]()

Question 9.

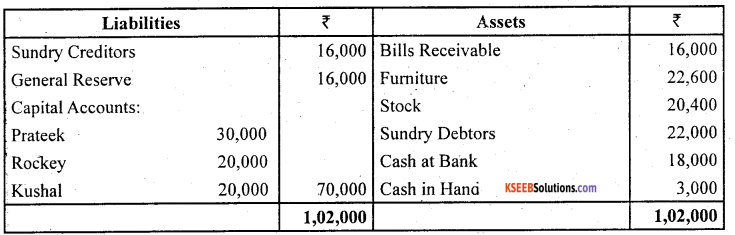

Following is the Balance Sheet of Prateek, Rockey and Kushal as on March 31, 2015. Balance Sheet of Prateek, Rockey and Kushal as on March 31, 2015

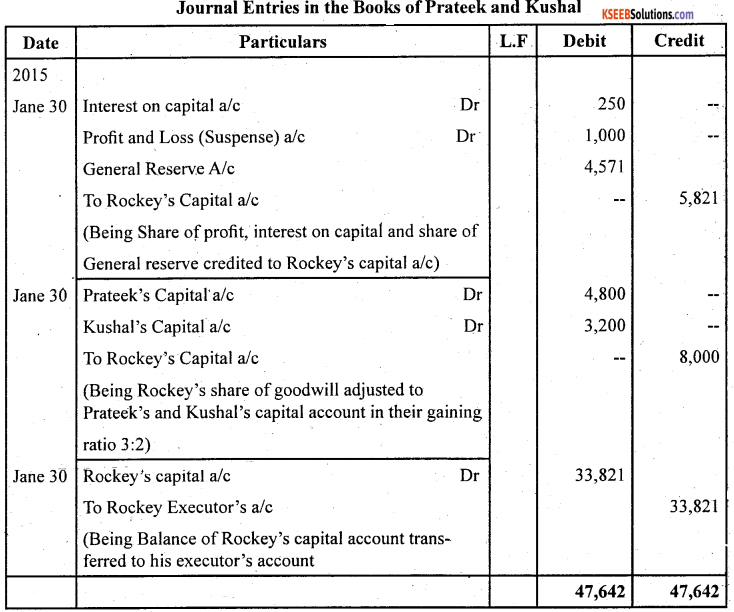

Rockey died on June 30, 2015. Under the terms of the partnership deed, the executors of a deceased partner were entitled to:

(a) Amount standing to the credit of the Partner’s Capital account.

(b) Interest on capital in 5% per annum.

(c) Share of goodwill on the basis of twice the average of the past three years’ profit and

(d) Share of profit from the closing date of the last financial year to the date of death on the basis of last year’s profit.

Profits for the year ending on March 31, 2013, 2014 and 2015 were ₹ 12,000, ₹ 16,000 and ₹ 14,000 respectively. Profits were shared in the ratio of capitals.

Pass the necessary journal entries and draw up Rockey’s capital account to be rendered to his executor.

Answer:

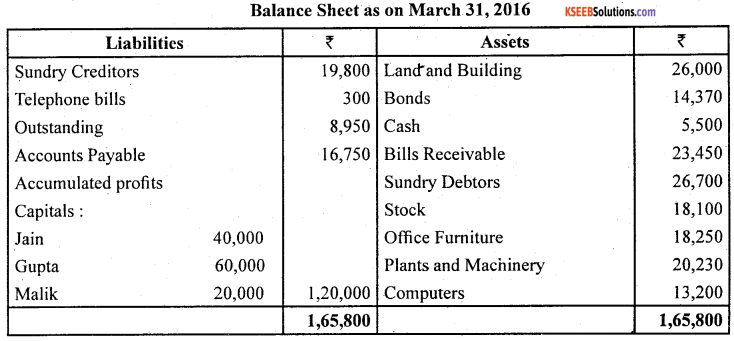

Question 10.

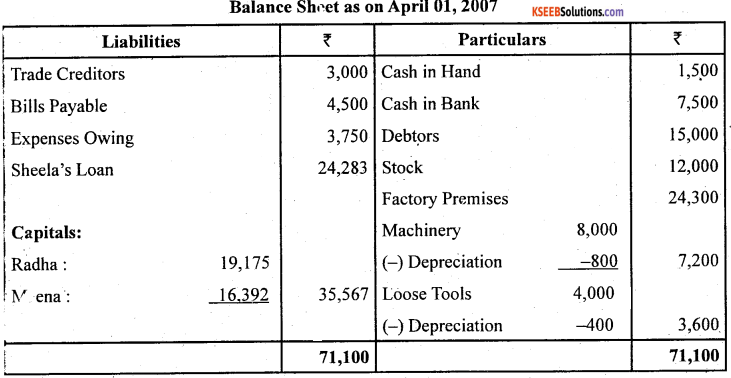

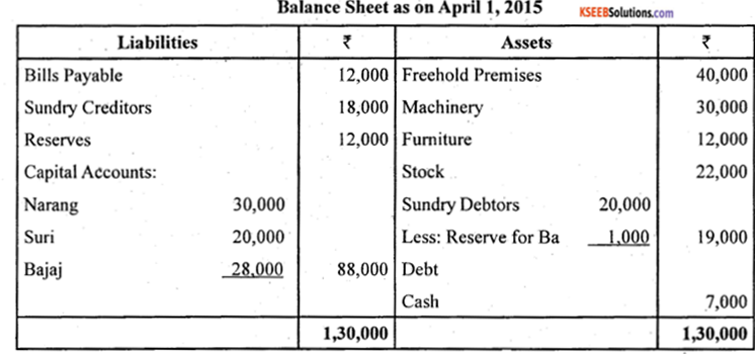

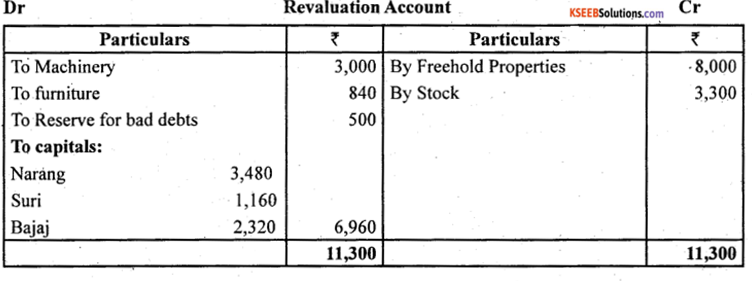

Narang, Suri and Bajaj are partners in a firm sharing profits and losses in proportion of 1 2,1 6 and 1 3 respectively. The Balance Sheet on April 1, 2015 was as follows: Books of Suri, Narang and Bajaj

Bajaj retires from the Business and the partners agreed to the following:

(a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

(b) Machinery and Furniture are to be depreciated by 10% and 7% respectively.

(c) Bad Debts reserve is to be increased to ? 1,500.

(d) Goodwill is valued at ₹ 21,000 on Bajaj’s retirement.

(e) The continuing partners have decided to adjust their capitals in their new profit sharing ratio after retirement of Bajaj. Surplus/deficit, if any, in their capital accounts will be adjusted through current accounts.

Prepare necessary ledger accounts and draw the Balance Sheet of the reconstituted firm.

Answer:

![]()

Question 11.

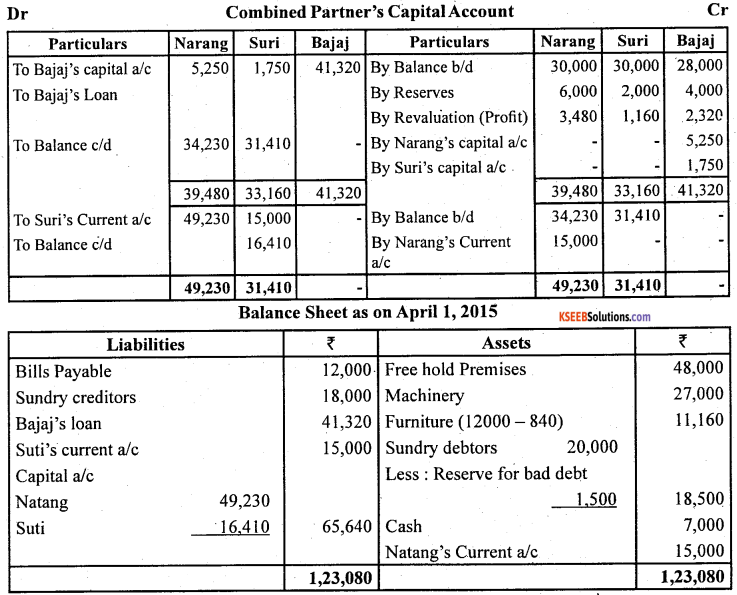

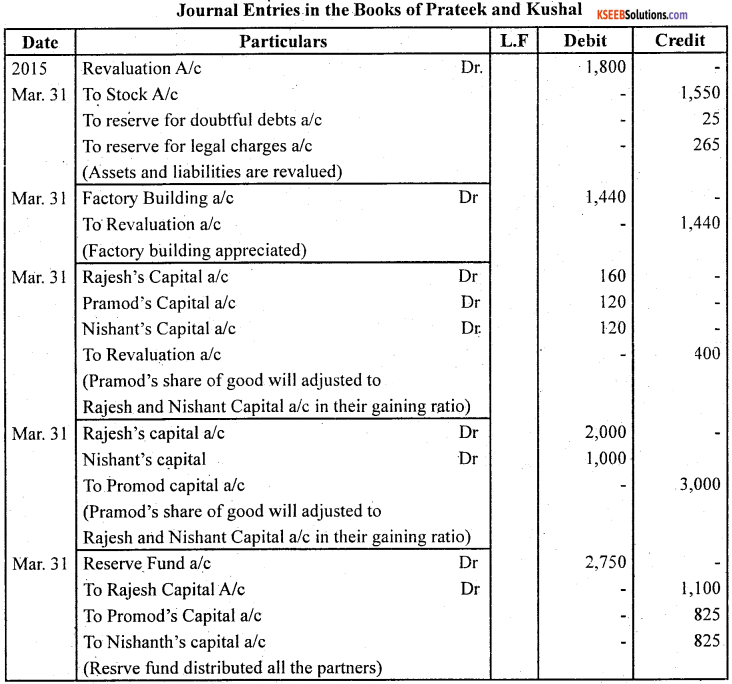

The Balance Sheet of Rajesh, Pramod and Nishant who were sharing profits in proportion to their capitals stood as on March 31, 2015:

Books of Rajesh, Pramod and Nishant

Pramod retired on the date of Balance Sheet and the following adjustments were made:

(a) Stock was valued at 10% less than the book value.

(b) Factory buildings were appreciated by 12%.

(c) Reserve for doubtful debts be created up to 5%.

(d) Reserve for legal charges to be made at ₹ 265.

(e) The goodwill of the firm be fixed at ₹ 10,000.

(f) The capital of the new firm be fixed at ₹ 30,000. The continuing partners decide to keep their capitals in the new profit sharing ratio of 3:2.

Pass journal entries and prepare the balance sheet of the reconstituted firm after transferring the balance in Pramod’s Capital account to his loan account.

Answer:

Question 12.

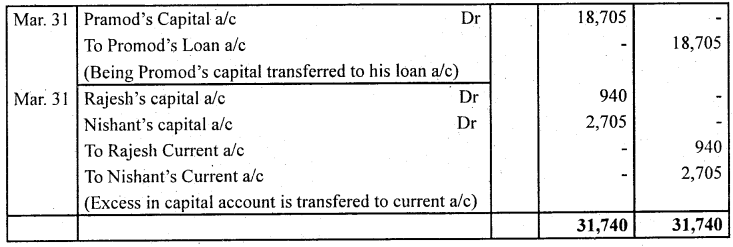

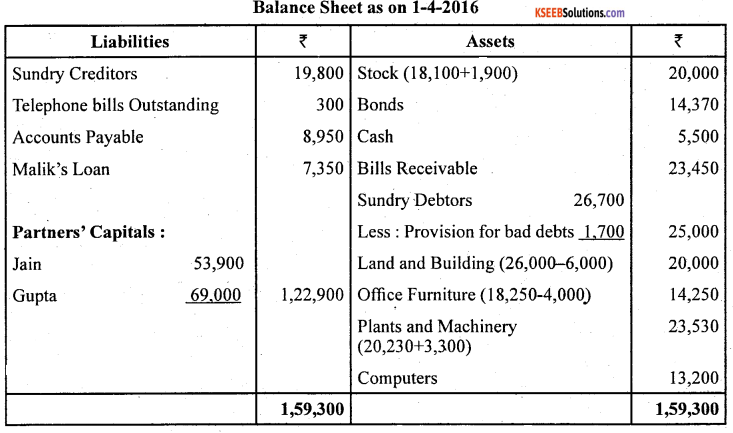

Following is the Balance Sheet of Jain, Gupta and Malik as on March 31, 2016. Books of Jain, Gupta and Malik

The partners have been sharing profits in the ratio of 5:3:2. Malik decides to retire from business on April 1, 2016 and his share in the business is to be calculated as per the following terms of revaluation of assets and liabilities: Stock, ₹ 20,000; Office furniture, ₹ 14,250; Plant and Machinery ₹ 23,530; Land and Building ₹ 20,000. A provision of ₹ 1,700 to be created for doubtful debts. The goodwill of the firm is valued at ₹ 9,000.

The continuing partners agreed to pay ₹ 16,500 as cash on retirement of Malik, to be contributed by continuing partners in the ratio of 3:2. The balance in the capital account of Malik will be treated as loan.

Prepare Revaluation account, capital accounts, and Balance Sheet of the reconstituted firm.

Answer:

![]()

Question 13.

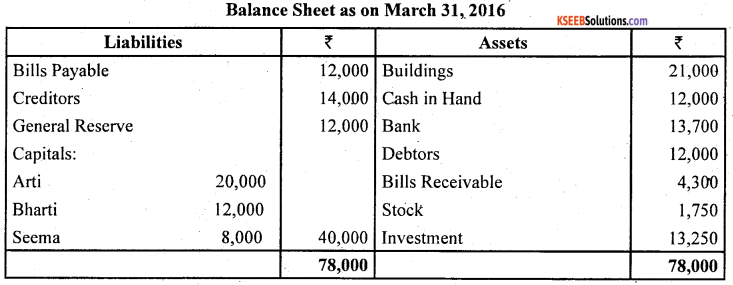

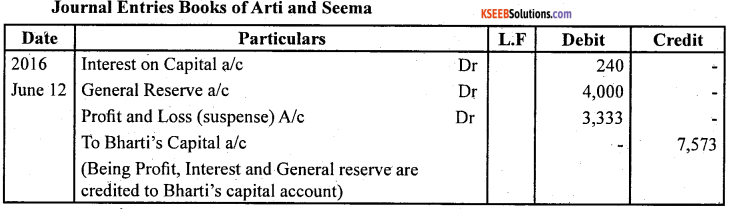

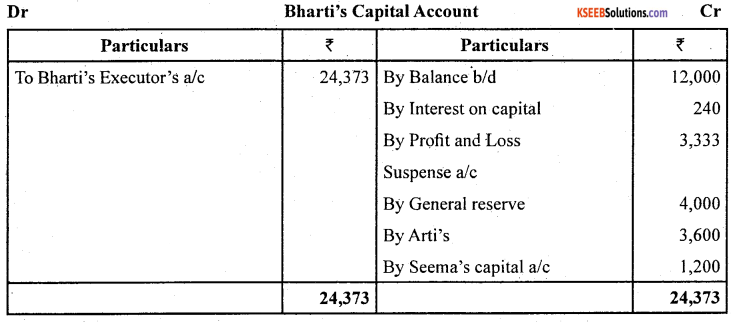

Arti, Bharti and Seema are partners sharing profits in the proportion of 3:2:1 and their Balance Sheet as on March 31, 2016 stood as follows :

Books of Arti, Bharti and Seema

Bharti died on June 12, 2016, and according to the deed of the said partnership, her executors are entitled to be paid as under :

(a) The capital to her credit at the time of her death and interest thereon @ 10% per annum.

(b) Her proportionate share of reserve fund.

(c) Her share of profits for the intervening period will be based on the sales during that period, which were calculated as ₹ 1,00,000. The rate of profit during past three years had been 10% on sales.

(d) Goodwill according to her share of profit to be calculated by taking twice the amount of the average profit of the last three years less 20%. The profits of the previous years were :

2013-₹8,200

2014.-₹9,000

2015-₹9,800

The investments were sold for ₹16,200 and her executors were paid out. Pass the necessary journal entries and write the account of the executors of Bharti.

Answer:

Question 14.

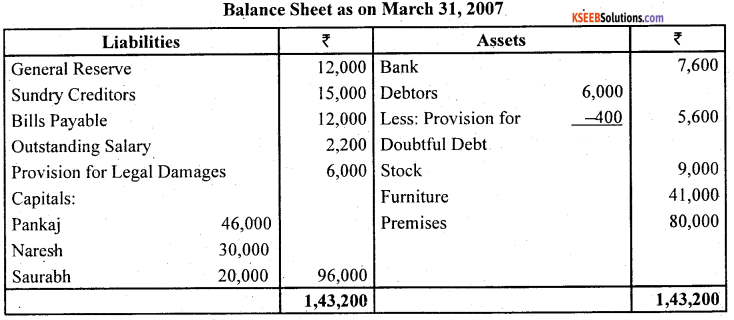

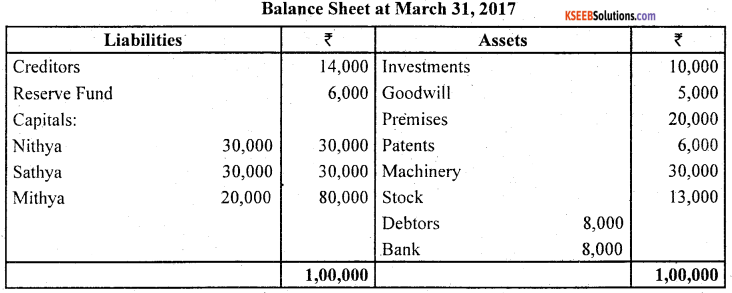

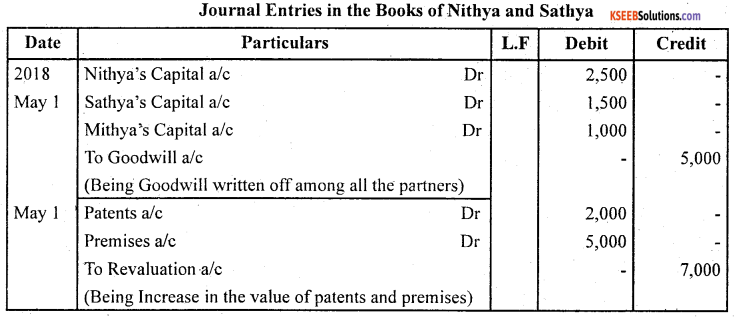

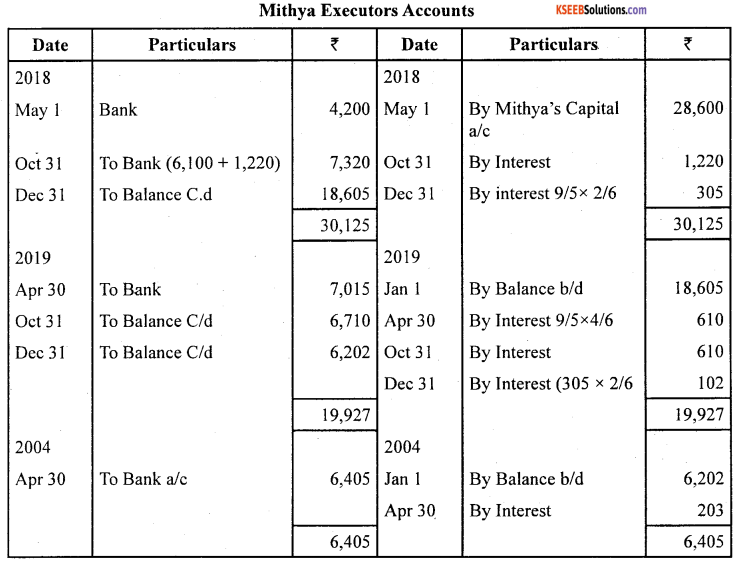

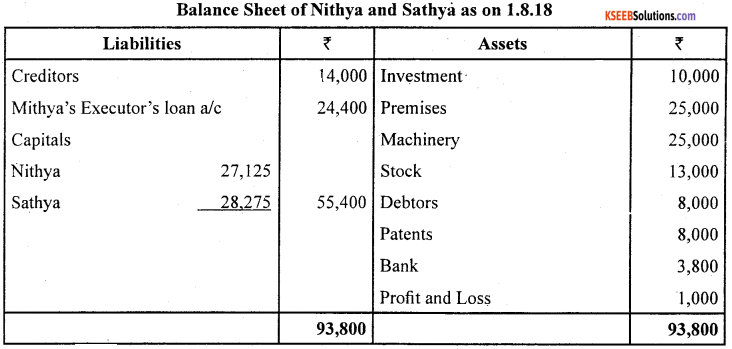

Nithya, Sathya and Mithya were partners sharing profits and losses in the ratio of 5:3:2. Their Balance Sheet as on March 31,2017 was as follows :

Books of Nithya, Sathya and Mithya

Mithya dies on August 1, 2018. The agreement between the executors of Mithya and the partners stated that:

(a) Goodwill of the firm be valued at 2 1/2 times the average profits of last four years. The profits of four years were : in 2014,₹ 13,000; in 2015, ₹ 12,000; in 2016, ₹ 16,000; and in 2017, ₹ 15,000.

(b) The patents are to be valued at ₹8,000, Machinery at ₹25,000 and Premises at ₹25,000.

(c) The share of profit of Mithya should be calculated on the basis of the profit of 2015.

(d) ₹ 4,200 should be paid immediately and the balance should be paid in 4 equal half-yearly instalments carrying interest @ 10%.

Record the necessary journal entries to give effect to the above and write the executor’s account till the amount is fully paid. Also prepare the Balance Sheet of Nithya and Sathya as it would appear on August 1, 2015, after giving effect to the adjustments.

Answer:

![]()

Test your Understanding -1

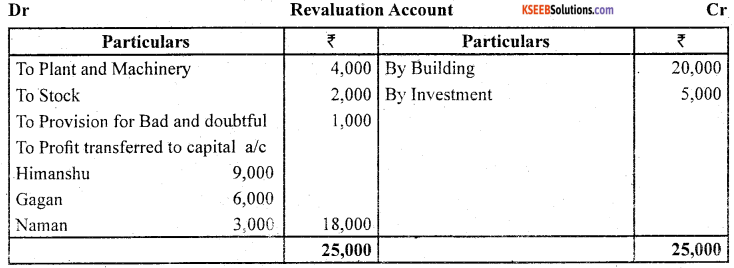

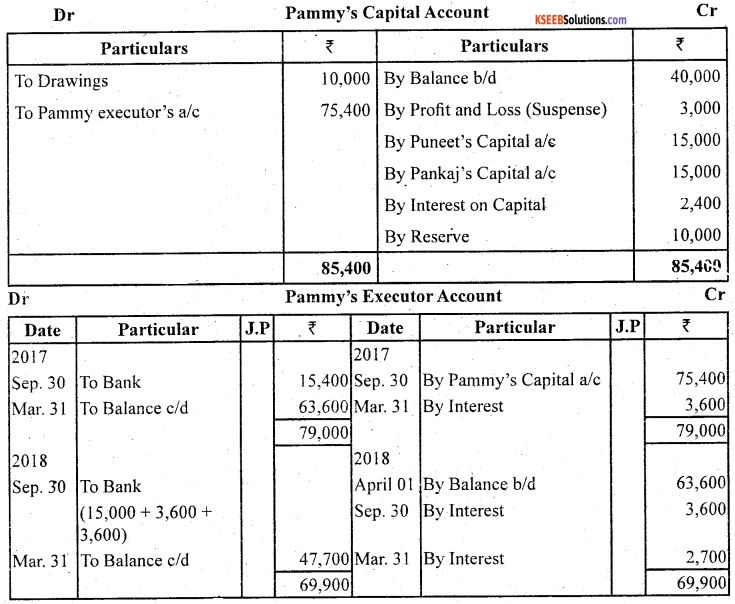

Choose the correct option in the following questions:

Question 1.

Abhishek, Rajat and Vivek are partners sharing profits in the ratio of 5:3:2. If Vivek retires, the New Profit Sharing Ratio between Abhishek and Rajat will be

(a) 3:2

(b) 5:3

(c) 5:2

(d) None of these

Answer:

(b) 5:3

Question 2.

The old profit sharing ratio among Rajender, Satish and Tejpal were 2:2:1. The New Profit Sharing Ratio after Satish’s retirement is 3:2. The gaining ratio is

(a) 3:2

(b)2:1

(c) 1:1

(d) 2:2

Answer:

(c) 1:1

Question 3.

Anand, Bahadur and Chander are partners. Sharing Profit equally On Chander’s retirement, his share is acquired by Anand and Bahadur in the ratio of 3:2. The New Profit Sharing Ratio between Anand and Bahadur will be-

(a) 8:7

(b) 4:5

(c)3:2

(d) 2:3

Answer:

(c). 3:2

Question 4.

In the absence of any information regarding the acquisition of share in profit of the retiring/deceased partner by the remaining partners, it is assumed that they will acquire his/her share:-

(a) Old Profit Sharing Ratio

(b) New Profit Sharing Ratio

(c) Equal Ratio

(d) None of these

Answer:

(a) Old Profit Sharing Ratio

![]()