Students can Download 2nd PUC Economics Previous Year Question Paper March 2019, Karnataka 2nd PUC Economics Model Question Papers with Answers helps you to revise the complete Karnataka State Board Syllabus and score more marks in your examinations.

Karnataka 2nd PUC Economics Model Question March 2019

Time: 3 hrs 15 minutes

Max. Marks: 100

PART-A

I. Choose the correct answer (5 × 1 = 5)

Question 1.

The scarce resources of an economy have

(a) Competing usages

(b) Single usages

(c) Unlimited usages

(d) None of the above

Answer:

(a) Competing usages

Question 2.

When the supply curve is vertical, the elasticity of supply is

(a) es = 1

(b) es = 1

(c) es = 0

(d) ex = ∞

Answer:

(c) es = 0

Question 3.

The change in TR due to the sale of an additional unit is called

(a) Total revenue

(c) Marginal revenue

(b) Average revenue

(d) Revenue

Answer:

(b) Marginal revenue

Question 4.

The year of Great Depression

(a) 1920

(b) 1889

(c) 1929

(d) 2018

Answer:

(c) 1929.

![]()

Question 5.

Easy availability of credit encourages

(a) Savings

(b) Investment

(c) Rate of interest

(d) None of the above

Answer:

(b) Investment

II. Fill in the blanks: (5 × 1 = 5)

Question 6.

Scarcity of resources gives raise to______

Answer:

Problem of choice.

Question 7.

_____is determined at the point where the demand for labour and supply of labour curves interect.

Answer:

Wages.

Question 8.

Competitive behaviour and competitive market structure are in general related.

Answer:

Inversely.

Question 9.

____goods will not pass through any more stages of production.

Answer:

Final goods.

![]()

Question 10.

Financial year runs from to in India.

Answer:

1st of April to 31st of March.

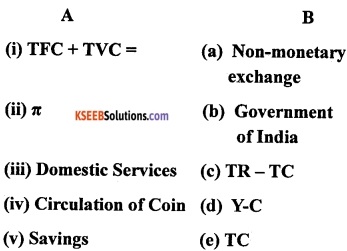

III. Match the following: (5 × 1 = 5)

Question 11.

Answer:

(i)-e; (ii) -c; (iii)-a; (iv)-b; (v)-d.

IV. Answer the following questions in a sentence/word: (5 × 1 = 5)

Question 12.

Expand MRS.

Answer:

MRS is the rate at which the consumer will substitute one product for another so that her total utility remains constant. It can be represented as follows:

MRS = ∆Y/∆X

Question 13.

What is monopoly?

Answer:

Monopoly is a market with only a single seller or firm.

Question 14.

Name the well known work of Adam Smith.

Answer:

Wealth of Nations.

Question 15.

Who are the ‘free riders’?

Answer:

Free riders are the consumers who will not voluntarily pay for what they can get for free and for which there is no exclusive title to the property being enjoyed. Here the link between the producer and the consumer is broken and the government steps in to provide for such goods.

![]()

Question 16.

What do you mean by open economy?

Answer:

An open economy is one which interacts with rest of the world through various channels.

PART-B

V. Answer any nine of the following questions in four sentences each (9 × 2 = 8)

Question 17.

What is monotonic preference?

Answer:

When the consumer always prefers more of the product which gives him higher level of satisfaction it is called monotonic preferences. That is, an increase in the amount of good 1 along the indifference curve is associated with a decrease in the amount of good 2. This implies that the slope of the indifference curve is downward.

Question 18.

Mention two different approaches which explain consumer behavior.

Answer:

The two approaches which explain consumer behaviour are:

- Cardinal utility analysis: Law of diminishing marginal utility.

- Ordinal utility analysis: Indifference curve analysis.

Question 19.

Give the meaning of price elasticity of supply and write its formula.

Answer:

The price elasticity of supply refers to the proportionate change in the quantity supplied of a commodity due to change in its price. In other words, the price elasticity of supply of a good measures the responsiveness of quantity supplied to changes in the price of the good. It is measured with the help of the following formula:

\(\text { Price elasticity of supply }=\frac{\text { Percentage change in quantity supplied }}{\text { Percentage change in price }}\)

Question 20.

Give the meaning of shut down point.

Answer:

In the short run, the shutdown point is that point of minimum average variable cost where short-run marginal cost curve cuts the average variable cost curve. In the long run, the shutdown point is the minimum of long-run average cost curve.

Question 21.

Mention the conditions needed for profit by a firm under perfect competition.

Answer:

The following conditions needed for profit by a firm under perfect competition:

- The price P must be equal to MC

- Marginal cost must be non-decreasing at q0

- The firm to continue to produce, in the short run, price must be greater than the average variable cost and in the long run, price must be greater than the average cost.

Question 22.

Write the meaning of monopolistic competition and give an example.

Answer:

When the market structure has large number of firms, free entry and exit of firms and differentiated goods, then it is called monopolistic competition.

For example, there is large number of soaps producing firms. But many of the soaps being produced are associated with some brand name and are distinguishable from the other companies. The consumer develops a preference for a particular brand of soap over time or becomes loyal to a particular brand like some people always prefer Mysore Sandal Soap.

![]()

Question 23.

What are the four factors of production? Mention their rewards.

Answer:

The four factors of production are land, labour, capital, and organisation. The rewards of these factors of production are as follows:

- Land gets rent

- Labour gets wages

- Capital gets interest

- Organisation gets profit.

Question 24.

Mention 3 methods of measuring GDP (national income).

Answer:

The three methods of measuring GDP are:

- Product or value-added method.

- Expenditure method.

- Income method.

Question 25.

Mention any two functions of money

Answer:

The functions of money are as follows:

1. Medium of exchange:

Money plays an important role as a medium of exchange. It facilitates exchange of goods for money. It has solved the problems of barter system. Money has widened the scope of market transactions. Money has become a circulating material between buyers and sellers.

2. Measure of value/unit of account:

The money acts as a common measure of value. The values of all goods and services can be expressed in terms of money.

3. Stork of value:

People can save part of their present income and hold the same for future. Money can be stored for precautionary motives needed to overcome financial stringencies. Money solves one of the deficiencies of barter system, i.e. difficulty to carry forward one’s wealth under the barter system.

4. Transfer of value:

Money acts as a transfer of value from person to person and from place to place. As a transfer of value, money helps us to buy goods, properties or anything from any part of the country or the world. Further, money earned in different places can be brought or transferred to anywhere in the world.

Question 26.

Write the meaning of excess demand and deficient demand?

Answer:

If the equilibrium level of output is more than the full employment level, it is due to the fact that the demand is more than the level of output produced at full employment level.

This situation is called excess demand. If the equilibrium level of output is less than the full employment of output, it is due to fact that demand is not enough to employ all factors of production. This situation is called deficient demand.

Question 27.

Give the meaning of investment multiplier. Write its formula.

Answer:

Investment multiplier is the ratio of the total increment in equilibrium value of final goods output to the initial increment in autonomous expenditure. Its formula is

Investment Multiplier = ∆Y/∆A= 1/1-c.

Where, ∆Y is the total increment in final goods output, ∆A is initial increment in autonomous expenditure and c is size of the multiplier.

![]()

Question 28.

Write the difference between public provision and public production?

Answer:

The difference between public provision and public production are as follows:

| Public Provision | Public Production |

| • A set of facilities financed by the government through its budget. • These are used without any direct payment. Examples are free education, mid-day meals, etc. |

• When the goods produced directly by the government, it is called public production. • These are used with direct payment. Examples are electricity, water supply, etc. |

Question 29.

Mention the three linkages of open economy.

Answer:

The three linkages of open economy are as follows:

- Output market linkage

- Financial market linkage

- Labour market linkage.

Question 30.

Why do people demand foreign exchange?

Answer:

People demand foreign exchange rate because of the following reasons:

- To purchase goods and services from other countries.

- To send gifts abroad.

- To purchase financial assets abroad.

PART-C

VI. Answer any seven of the following questions in twelve sentences each. (7 × 4 = 28)

Question 31.

Briefly explain the central problems of an economy.

Answer:

An economic system or economy is a mechanism where the scarce resources are channelized on priority to produce goods and services. These goods and services produced by all the sectors of the economy determine the national income.

Generally, human wants are unlimited and resources to satisfy them are limited. If there was a perfect match between human wants and availability of resources there would have been no scarcity, no problem of choice and no economic problems at all. So, one has to select the most essential want to be satisfied with limited resources. In economics, this problem is called ‘problem of choice’.

The problem of choice arising out of limited resourced and unlimited wants is called economic problem. Every economy whether developed or underdeveloped, capitalistic or socialistic or mixed economy, there will be three basic economic problems, viz. what to produce? how to produce? and for whom to produce? Let us discuss in detail.

a. What to produce, i.e. what is to be produced and in what quantities?

Every country has to decide, which goods are to be produced and in what quantities. Whether more guns should be produced or more food grains should be grown or whether more capital goods like machines, tools, etc. should be produced or more consumer goods (electrical goods, daily usable products, etc.) will be produced.

What goods to be produced and in what quantity depends on the economic system of the country. In socialistic economy, the government decides and in capitalistic economy market forces decides and in mixed economy both the government and market forces provide solutions to this problem.

b. How to produce, i.e. how are goods produced?

There are various alternative techniques of producing a product. For example, cotton cloth can be produced with either handloom or power looms. Production of cloth with handloom requires more labour and production with power loom use of more machines and capital. It involves selection of technology to produce goods and services.

There are two types of techniques of production, viz. labour-intensive technology and capital intensive technology. The society has to decide whether production be based on labour-intensive or capital intensive techniques. Obviously, the choice of technology would depend on the availability of different factors of production (land, labour, capital) and their relative prices (rent, wages, interest).

c. For whom to produce, i.e. for whom are the goods to be produced?

Another important decision which an economy has to take is for whom to produce. The economy cannot satisfy all wants of all the people. Therefore, it has to decide who should get how much of the total output of goods and services. The society has to decide about the shares of different groups of people poor, middle class and the rich, in the national output.

Thus, every economy faces the problem of allocating the scarce resources to the production of different possible goods and services and of distributing the produced goods and services among the individuals within the economy. The allocation of scarce resources and the distribution of the final goods and services are the central problems of any economy.

Question 32.

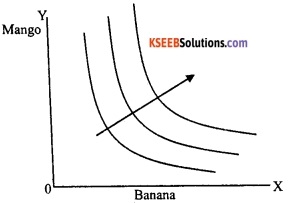

Explain the in difference map with the diagram.

Answer:

A family of indifference curves is called as in difference map. It refers to a set of indifference curves for two commodities showing different levels of satisfaction. The higher indifference curves show higher level of satisfaction and lower indifference curve represent lower satisfaction. A rational consumer always chooses more of that product which offers him a higher level of satisfaction which is represented in higher indifference curve. It is also called ‘monotonic preferences’.

The consumer’s preferences over all the bundles . can be represented by a family of indifference curves as shown in the following diagram.

Question 33.

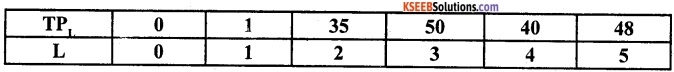

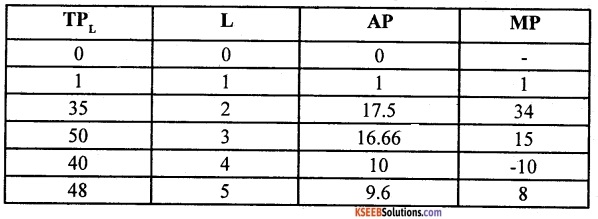

The following table gives the TP schedule of labour. Find the corresponding Average product and marginal product schedules.

Answer:

Calculation of average product (AP) and marginal product (MP). AP is obtained by dividing TPL by labour (L) and MP is obtained from TPL with the help of formula TCn – TCn-1

Question 34.

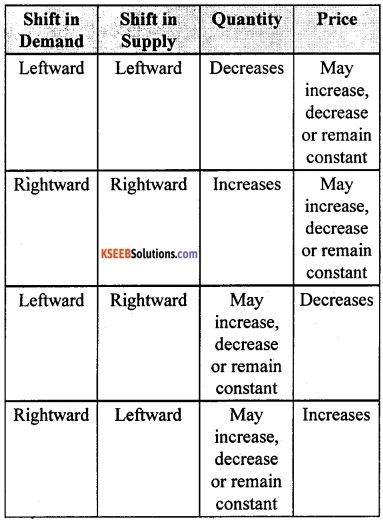

Write a table to show the impact of simultaneous shifts on equilibrium.

Answer:

The following table shows the impact of simultaneous shifts on equilibrium:

Question 35.

Explain the features of perfect competition.

Answer:

Perfect competition is a market where there will be existence of large number of buyers and sellers dealing with homogenous products. It is a market with highest level competition.

1. Large number of sellers and buyers:

The first condition which a perfectly competitive market must satisfy is concerned with the sellers’ side of the market. The market must have such a large number of sellers that no one seller is able to dominate in the market. No single firm can influence the price of the commodity. The sellers will be the firms producing the product for sale in the market. These firms must be all relatively small as compared to the market as a whole.

Their individual outputs should be just a fraction of the total output in the market. There must be such a large number of buyers that no one buyer is able to influence the market price in any way. Each buyer should purchase just a fraction of the market supplies. Further, the buyers should have any kind of union or association so that they compete for the market demand on an individual basis.

2. Homogeneous products:

Another prerequisite of perfect competition is that all the firms or sellers must sell completely identical or homogeneous goods. Their products must be considered to be identical by all the buyers in the market. There should not be any differentiation of products by sellers by way of quality, colour, design, packing or other selling conditions of the product.

3. Free entry and free exit for firms:

Under perfect competition, there is absolutely no restriction on entry of new firms in the industry or the exit of the firms from the industry which want-to leave. This condition must be satisfied especially for long period equilibrium of the industry.

If these three conditions are satisfied, the market is said to be purely competitive. In other words, a market characterized by the presence of these four features is called purely competitive. For a market to be perfect, some conditions of perfection of the market must also be fulfilled.

4. Price taker:

The single distinguishing character of perfect competition is the price-taking behaviour of the firms. A price-taking firm believes that if it sets a price above the market price, it will be unable to sell any quantity of the good that it produces. On the other hand, if the firm set the price less than or equal to the market price, the firm can sell as many units of the good as it wants to sell.

The firms in the perfect competitive market are price takers. That means, the producers will continue to sell their goods and services in the price existing in the market. Firms have no control over the price of the product.

5. Information is perfect:

Price taking is often thought to be a reasonable assumption when the market, has many firms and buyers have perfect information about the price prevailing in the market. Since all firms produce the same good and all buyers are aware of the market price, the firm in question loses all its buyers if it raises price.

![]()

Question 36.

Briefly explain in what way Macro Economics is different from Micro Economics

Answer:

The micro and macroeconomics are distinguished on the following grounds:

1. Scope:

- Microeconomics study in individual units so its scope is narrow.

- Macroeconomics study in aggregates, so its scope is wider.

2. Method of study:

- The microeconomics follows slicing method as it studies individual unit.

- The macroeconomics follows lumping method as it studies in aggregates.

3. Economic agents:

- In microeconomics, each individual economic agent thinks about its own interest and welfare.

- In macroeconomics, economic agents are different among individual economic agents and their goal is to get maximum welfare of a country.

4. Equilibrium:

- Microeconomics studies the partial equilibrium in the country.

- Macroeconomics studies the general equilibrium in the economy.

5. Domain:

- Microeconomics consists of theories like consumer’s behaviour, production, and cost, rent, wages, interest, etc.

- Macroeconomics comprises of theory of income, output, and employment, consumption function, investment function, inflation, etc.

Question 37.

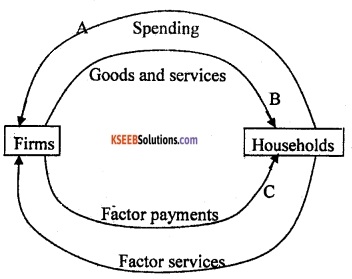

Explain the circular flow of income of an economy.

Answer:

The circular flow of income of an economy can be explained with the help of following assumptions:

- Existence of two sectors, viz. household sector and producers.

- Households are the owners of the factors of production.

- Households receive income by selling the factor services.

- There are no savings.

- The firms produce goods to the households.

- The economy is a closed economic system (where no government or external trade or savings).

The circular flow of income in a simple economy can be illustrated with the help, of following chart.

In the above chart, the uppermost arrow, going from the households to the firms, represents the spending by the households to buy goods and services produced by the firms. The second arrow going from the firms to the households is the counterpart of the arrow above. It stands for the goods and services, which are flowing from the firms to the households.

Thus, the two arrows on the top represent the goods and services market the arrow above represents the flow of payments for the goods and services, the arrow below represents the flow of goods and services. The two arrows at the bottom of the diagram similarly represent the factors of the production market.

The lowermost arrow going from the households to the firms symbolizes the services that the households re-rendering to the firms. Using these services, the firms are producing the output. The arrow above this, going from the firms to the households, represents the payments made by the firms to the households for the services provided by the households.

Thus, when the income is spent on the goods and services produced by the firms, it takes the form of aggregate expenditure received by the firms. Since the value of expenditure must be equal to the value of goods and services, we can measure the aggregate income by calculating the aggregate value of goods and services produced by the firms. This is clearly shown above in the form of circular flow of income.

Question 38.

Write a note on externalities.

Answer:

An externality is a cost or benefit conferred upon second or third parties as a result of acts of individual production and consumption. But the cost or benefit of an externality cannot be measured in money terms because it is not included in market activities.

In other words, externalities refer to the benefits or harm a firm or an individual causes to another for which they are not paid or penalized. They do not have any market in which they can be bought and sold. There are two types of externalities viz.,

- Positive externalities

- Negative externalities.

For example, let us imagine that there is chemical fertilizer industry. It produces the chemical fertilizers required for agriculture. The output of the industry is taken for counting GDP of an economy. This is positive externality.

While carrying out the production, the chemical fertilizer industry may also be polluting the nearby river. This may cause harm to the people who use the water of the river. Hence their health will be affected. Pollution also may kill fish and other organisms of the river. As a result, the fishermen of the river may lose their livelihood. Such harmful effects that the industry is inflicting on others, for which it will not bear any cost are called negative externalities.

![]()

Question 39.

Briefly explain the functions of RBI.

Answer:

The main functions of RBI are as follows:

a. Printing and issuing currency notes:

It has complete authority of printing and issuing currency notes in the country. RBI issues all denominations of currency notes (Rs.2, Rs. 10, Rs.20, Rs.50, Rs. 100, Rs.500 and Rs.2000) except one rupee note, which is issued by finance ministry, Government of India. The minimum reserve system of note issue was followed by RBI after 1956.

b. Lender of last resort:

RBI provides financial assistance to commercial banks like giving credit, discounting bills, giving advances, etc. during their financial crisis and helps the banks as a lender of last resort.

c. Act as banker to the government

d. Controls credit creation activities of commercial banks:

The credit provided by all commercial banks is controlled by RBI. RBI implements both quantitative and qualitative techniques to control the credit generated by commercial banks. The quantitative measures to control credit are bank rate policy, open market operations, repo and reverse repo rates, cash reserve ratio, and statutory liquidity ratio.

e. Controls money market:

RBI is the leader of money market. All the activities id components of money market. like commercial banks and financial institutions are controlled and directed by RBI.

f. Act as banker to the banks

g. Custodian of foreign exchange reserves.

Question 40.

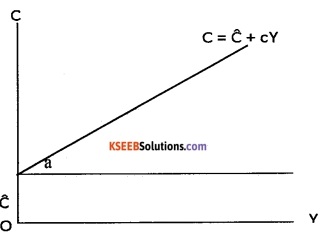

Briefly explain consumption function.

Answer:

The consumers demand can be expressed by the equation C = \(\hat{\mathrm{C}}\) + cY, where \(\hat{\mathrm{C}}\) is autonomous expenditure and c is the marginal propensity to consume.

The consumption function can be graphically expressed as given in the diagram. In the above diagram, \(\hat{\mathrm{C}}\) is the intercept of the consumption and ‘c’ is slope of consumption function equals α.

Question 41.

Explain the merits and demerits of flexible and fixed exchange rate system.

Answer:

1. Flexible exchange rate:

The flexible exchange rate is determined by the market forces of demand and supply. Here, the exchange rate is determined at that point where the demand curve intersects with the supply curve.

Merits of flexible exchange rate:

- The flexible exchange rate system gives the government more flexibility and they do not need to maintain large stocks of foreign exchange reserves.

- The movements in the exchange rate automatically take care of the surpluses and deficits in the balance of payments.

Demerits of flexible exchange rate:

- It is subject to international market fluctuations as the rate of exchange is determined by market forces demand and supply.

- It may lead to uncertainties in foreign exchange market due speculations.

2. Fixed exchange rate:

Under this exchange rate system, the government fixes the exchange rate at a particular level. Here, the central monetary authority or the government decides the exchange rate in accordance with the international market requirements.

Merits of fixed exchange rate:

- There is more credibility that the government will be able to maintain the exchange rate at the level specified.

- In case of deficit balance of payments, the governments will interfere to take care of the gap by use of its official reserves.

Demerits of fixed exchange rate:

- If the foreign exchange reserves are inadequate, people would begin to doubt the ability of the government.

- There may be aggressive buying of one currency forcing the government to devalue, so there may be speculative attack on a currency.

PART-D

VII. Answer any four of the following questions in 20 sentences each (4 × 6 = 24)

Question 42.

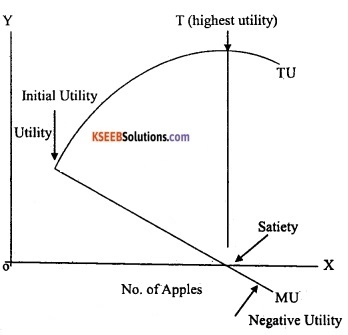

Explain the law of diminishing marginal utility with the help of a table and diagram.

Answer:

One of the most important propositions of the cardinal utility approach to demand was the Law of Diminishing Marginal Utility. German Economist Gossen was the first to explain it. Therefore, it is called Gossen’s First Law.

According to Alfred Marshall, “The additional benefit which a person derives from a given increase of a stock of a thing diminishes, other things being equal, with every increase in the stock that he already has”.

This law simply tells us that, we obtain less and less utility from the successive units of a commodity as we consume more and more of it.

Assumptions of the Law of DMU

1. Uniform quality and size of the commodity:

The successive units of the commodity should not differ in any way either in quality or size.

2. Suitable quantity of consumption:

The Commodity units should not be very small, e.g. milk should be in glasses and not in spoons.

3. Consumption within the same time:

Consumption must be continuous. There should not be so much difference in time between the consumption of successive units.

4. No change in the price of the commodity or its substitutes:

The law is based on the assumption that the commodity’s price is not changed with successive units. The price of the substitutes is also kept at the same level.

5. Utility can be measured in cardinal numbers, i.e. 1, 2, 3, 4, …….

6. Consumer must be rational, i.e. every consumer wants to maximize his satisfaction.

The basis of this law is that every want needs to be satisfied only up to a limit. After this limit is reached the intensity of our want becomes zero. It is called complete satisfaction of the want. Therefore, we consume more and more units of a commodity to satisfy our need, the intensity of our want for it becomes less and less.

Therefore, the utility obtained from the consumption of every unit of the commodity is less than that of the units consumed earlier. This can be explained with the help of the following table.

| Units of Apples | Total Utility (TU) | Marginal Utility (MU) |

| 1 | 30 | 30 |

| 2 | 50 | 20 |

| 3 | 65 | 15 |

| 4 | 75 | 10 |

| 5 | 80 | 5 |

| 6 | 82 | 2 |

| 7 | 82 | 0 |

| 8 | 80 | -2 |

Suppose a man wants to consume apples and is hungry. In this condition, if he gets one apple, he has very utility for it. Let us say that the measurement of this utility is equal to 30 utils. Having eaten the first he will not remain so hungry as before. Therefore, if he consumes the second apple he will have a lesser amount of utility from the second apple even if it was exactly like first one.

The utility he got from the second apple equals 20 units, the third, fourth, fifth and sixth apples give him utility equal to 15, 10, 5 and 2 units respectively. Now, if he is given the seventh apple he has no use for it. That means the utility of the seventh apple to the consumer is zero.

It is just possible that if he is given the eighth apple for consumption, it may harm him. Here the utility will benegative, i.e. -2. Therefore, we are clear that the additional utility of the successive apples to the consumer goes on diminishing as he consumes more and more of it.

The Law of Diminishing Marginal Utility can be explained with the help of the following diagram.

In the diagram, the horizontal axis shows the units of apples and the vertical axis measures the MU and TU obtained from the apple units. The total utility curve will be increasing in the beginning and later falls. The marginal utility curve is falling from left down to the right clearly tells us that the satisfaction derived from the successive consumption of apples is falling.

The marginal utility of the first apple is known as initial utility. It is 30 utils. The marginal utility of the seventh apple is zero. Therefore, this point is called the satiety point. The marginal utility of the eighth apple is -2. So, it is called negative utility and lies below the X-axis.

![]()

Question 43.

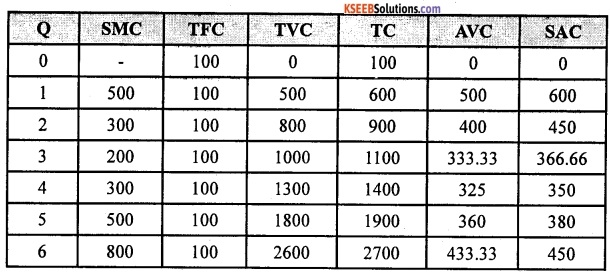

A firm’s SMC schedule is shown in the following table. TFC is Rs.100. find TVC, TC, AVC and SAC schedules of the firm.

Answer:

Note: TFC is given. TVC is obtained by adding SMC for each unit of output like 500 as it is taken, then 500+300=800; 800+200 (SMC)=1000 and so on. TC is TFC + TVC, AVC is TVC divided by Q and SAC is TC divided by Q.

Question 44.

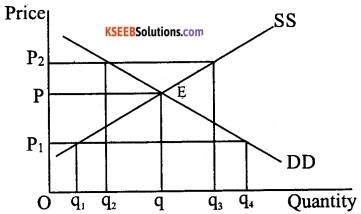

Explain the market equilibrium with the fixed number of firms with the help of diagram.

Answer:

Under perfect competition, market is said to be in equilibrium when quantity demanded is equal to the quantity supplied. Here, with the help of market demand curve and market supply curve, we will determine where the market will be in equilibrium when the number of firms is fixed.

This can be illustrated with the help of the following diagram.

The given diagram illustrates equilibrium for a perfectly competitive market with a fixed number of firms. SS is market supply curve and DD is market demand curve. The market supply curve SS shows how much of the commodity firms would wish to supply at different prices and the demand curve DD tells us how much of the commodity, the consumer would be willing to purchase at different prices.

At point E, the market supply curve intersects the market demand curve which denotes that quantity demanded is equal to quantity supplied. At any other point, either there is excess supply or there is excess demand.

OP is the equilibrium price and Oq is the equilibrium quantity. If the price is P1, the market supply is q1 and market demand is q4. Therefore, there is excess demand in the market equal to q1q4 Some consumers who are either unable to obtain the commodity at all or obtain it in insufficient quantity will be willing to pay more than P1 The market price would tend, to increase.

All other things remaining constant, when the price increases the demand falls and quantity supplied rises. The market moves towards equilibrium where quantity demanded is equal to quantity supplied. It happens at P where supply decisions match demand decisions.

If the price is P2, the market supply q31 will exceed the market demand q2 which leads to excess supply equal to q2q3 Some firms will not be able to sell quantity they want to sell. Therefore, they will lower their price.

All other things remaining constant, when the price falls, quantity, demanded rises and quantity supplied falls to equilibrium price P where the firms are able to sell their desired output as market demand equals market supply at P. So, the P is the equilibrium price and the corresponding quantity q is the equilibrium quantity.

Question 45.

Explain how the firms behave in oligopoly.

Answer:

If the market of a particular commodity consists of a few number of sellers, the market structure is termed oligopoly. Given there are a few firms, each firm is relatively large when compared to the size of the market. As a result each firm is in a position to affect the total supply in the market and thus influence the market price.

For example, if a firm decides to double its output, the total supply in the market will increase, causing the price to fall. This fall in price affects the profits of all firms in the industry. Other firms will respond to such a move in order to protect their own profits, by taking fresh decisions regarding how much to produce. Therefore the level of output in the industry, the level of prices and the profits are outcomes of how firms are interacting with each other.

Case-1:

Firms could decide to collude with each other to maximize profits. Here the firms form a Cartel (an association) that acts as a monopoly. The quantity supplied collectively by the industry and the price charged are the same as a single monopoly firm.

Case-2:

The firms could decide to compete with each other. For example, a firm may lower its price a little below the other firms, in order to attract away their customers. Certainly, the other firms would retaliate by doing the same. So the market price keeps falling.

In reality, cooperation of the kind that is needed to ensure a monopoly outcome is often difficult to achieve in the real world. The firms may realize that competing fiercely by continuous price cuts is harmful to their own profits.

Question 46.

Explain the macro economic identities.

Answer:

The macroeconomic identities are as follows:

1. Gross domestic product (GDP):

Gross domestic product measures the aggregate production of final goods and services taking place within the domestic economy during a year. But the whole of it may not accrue to the citizens of the country. It includes GDP at market prices and GDP at factor cost.

GDP at market price is the market value of all final goods and services produced within a domestic territory of a country measured in a year. Here everything is valued at market prices. It is obtained as follows:

GDPMP = C + I + G + X – M

GDP at factor cost is gross domestic product at market prices minus net indirect taxes. It measures money value of output produced by the firms within the domestic boundaries of a country in a year.

GDPFC = GDPMP – NIT.

2. Gross national product:

It refers to all the economic output produced by a nation’s normal residents, whether they are located within the national boundary or abroad. It is defined as GDP plus factor income earned by the domestic factors of production employed in the rest of the world minus factor income earned by the factors of production of the rest of the world employed in the domestic economy. Therefore,

GNP = GDP + Net factor income from abroad.

3. Net national product (NNP):

A part of the capital gets consumed during the year due to wear and tear. This wear and tear is called depreciation. If we deduct depreciation from GNP the measure of aggregate income that we obtain is called net national product. We get the value of NNP evaluated at market prices. So,

NNP = GNP – Depreciation.

4. Net national product (NNP) at factor cost:

The NNP at factor is the sum of income earned by all factors in the production in the form of wages, profits, rent, and interest, etc. belong to a country during a year. It is also known as national income. We need to add subsidies to NNP and deduct indirect taxes from NNP to obtain NNP at factor cost.

NNPFC = NNP at market prices – indirect taxes + subsidies

5. Personal income (PI):

It refers to the part of national income (NI) which is received by households. It is obtained as follows:

PI = NI – Undistributed Profits -Net interest payments made by the households – Corporate tax + Transfer payments to the households from the government and firms.

6. Personal disposable income (PDI):

If we deduct the personal tax payments (income tax) and non-tax payments (fines, fees) from personal income, we get PDI. Therefore,

PDI = PI – Personal tax payments – Non-tax payments.

Question 47.

Explain the classification of receipt.

Answer:

The government budget consists of revenue budget and capital budget. Both the budgets have receipts viz., revenue receipts and capital receipts.

I. Revenue receipts:

Revenue receipts are those receipts which do not lead to a claim on the government. They include the following:

- Tax revenue.

- Non-tax revenue.

1. Tax revenues:

These are the important component of revenue receipts. Tax revenue consists of direct tax and indirect taxes. The direct tax includes income tax, corporate tax and indirect tax includes excise duty (tax on production of goods in the country), customs duties (tax on exports and imports) and service tax (GST-goods and services tax has been introduced in place of indirect taxes from 1st July 2017). Other direct taxes like wealth tax and gift tax have never brought in large amount of revenue and thus they are called as paper taxes.

2. Non-tax revenue:

The non-tax revenue of the central government consists of the following:

- Interest receipts on account of loans by the central government

- Dividends and profits on investments made by the government

- Fees and other receipts for services rendered by the government

- Grants-in-aid from foreign countries and international organizations.

II. Capital receipts:

All those receipts of the government which create liability or reduce financial assets are termed as capital receipts. The government receives money by way of loan or from the sale of its assets. Loans have to be repaid to the agencies from whom the government has borrowed. Thus it creates liability. Sale of government assets like sale of shares in public sector undertakings (disinvestment) reduces the total amount of financial assets of the government.

When government takes fresh loans it means that it has to be returned with interest. Similarly, when government sells an asset it means that in future its earnings from that asset will disappear. Thus, these receipts can be debt creating or non-debt creating.

![]()

Question 48.

Write a note on balance of payment.

Answer:

The balance of payments is the record of the transactions in goods, services and assets between residents of a country with the rest of the world for a specified time period, i.e. a year. The balance of payments consists of two accounts, viz. current account and capital account.

1. Current account:

It is the record of trade in goods and services and transfer payments. The main components of current account are trade in goods, i.e. exports and imports of goods. The trade-in services includes the factor income and non-factor income transactions. Transfer payments are the receipts which the residents of a country get for free without having to provide any goods or services in return. They consist of gifts, remittances, and grants. They could be given by the government or by private citizens living abroad.

Current account is in balance when receipts on current account are equal to the payments on the current account. A surplus current account means that the nation is a lender to other countries and a deficit current account means that the nation is a borrower from other countries.

2. Capital account:

It is the record of all international transactions of assets. An asset is any one of the forms in which wealth can be held. For example, stocks, bonds, government debt, etc. Purchase of assets is a debit item on the capital account. If an Indian buys a UK car company it inters capital account transactions as a debit item.

On the other hand, sale of assets like sale of share of an Indian company to a USA customer is a credit item on the capital account. The capital account mainly consists of foreign direct investment, foreign institutional investments, external borrowings, and assistance.

The capital account will be in balance when capital inflows are equal to capital outflows. Surplus in capital account arises when capital flows are greater than capital out flows and deficit in capital account arises when capital inflows are lesser than capital outflows.

3. Capital inflows:

Loans from abroad, sale of assets or shares in foreign companies.

4. Capital outflows:

Repayment of loans, purchase of assets or shares in foreign countries.

PART-E

VIII. Answer any four of the following questions in 20 sentences each (2 × 5 = 10)

Question 49.

A consumer wants to consume two goods. The Price of bananas is ₹4 and price of mangoes is ₹5. The consumer income is ₹20.

- How much bananas can she consume if she spend her entire income on that good

- How much mangoes can she consume if she spend her entire income on that good

- Is the slope of budget line is downward or upward

- Are the bundles on the budget line equal to the consumers’ income or not

- If you want to have more of banana you have to give up mangoes. Is it true?

Answer:

- 5 Bananas (20/4).

- 4 Mangoes (20/5).

- Slope of budget line is downward.

- Yes, the bundles on the budget line are equal to the consumer’s income.

- True, if we want to have more of banana we have to give up mangoes.

Question 50.

Write a note on Demonetisation.

Answer:

Demonetisation was a new step taken by the Government of India on 8th November 2016. It was introduced to tackle the problem of corruption, black money, terrorism and circulation of fake currency in the economy. Old currency notes of Rs.500 and Rs. 1000 were no longer legal tender.

New currency notes in denomination of Rs.500 and Rs.2000 were introduced. The public were advised to deposit old currency notes in their bank account till 31st of March 2017 without any declaration and after 31st March 2017 with the RBI with declaration.

In order to avoid a complete Breakdown and scarcity of Cash, government allowed exchange of Rs.4000 old currency notes with new currency restricting to a person per day. Further, till 12th December 2016, old currency notes were acceptable as legal tender at petrol pumps, government hospitals and for payment of government dues like taxes, power bills, etc.

This initiative had both appreciation and criticism. There were long queues outside banks and ATM centres. There was acute shortage of currency notes and had adverse effect on economic activities. But now, normalcy has returned.

The demonetization also has positive effects. It improved tax compliance as a large number of people were bought in the tax ambit. The savings of individual were channelized into the formal financial system. As a result, banks have more resources at their disposal which can be used to provide more loans at low rate of interest.

Demonetisation helps in curbing black money, reducing tax evasion and corruption will decrease. It also helps in tax administration in another way, by shifting transaction out of the cash economy into the formal payment system. Nowadays, households and “firms have started to shift from cash payment to electronic payments.

![]()

Question 51.

Name the currencies of any five countries of the following. USA, UK, Germany, Japan, China, Argentina, UAE, Bangladesh, Russia.

Answer:

| Countries | Currency |

| USA | US dollars |

| UK | British Pound |

| Germany | Euro |

| Japan | Japanese Yen |

| China | Chinese yuan |

| Argentina | Argentine peso |

| UAE | UAE dirham |

| Bangladesh | Bangladeshi taka |

| Russia | Russian Ruble |